1.

Crypto valuation metrics – How to value crypto?

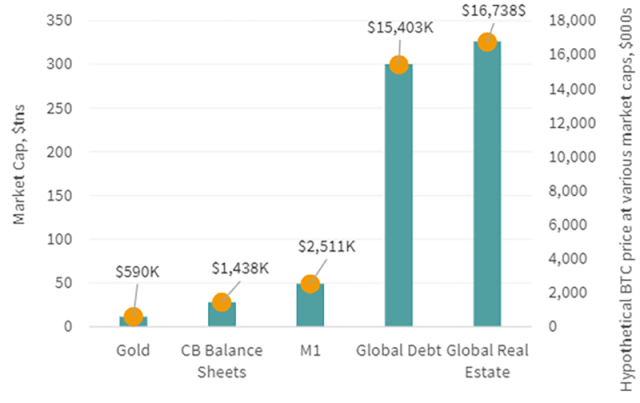

Compare with the alternatives. One way to measure bitcoin's value is to determine which asset classes or securities it competes with and. The market capitalization of any given coin is calculated by multiplying the value of one unit with the supply in circulation. Chart 4 below.

The network value equals the price of an assets times its circulating supply and is divided by the transcation volume in USD of the last 24h. To estimate bitcoin's fair value, we measure the number of users with the number of addresses holding at least bitcoin.

Currently, there. Cryptocurrencies are a new type of asset, and there is no agreement yet in the market on how to value them.

\The valuation varies greatly. Take the Bitcoin market capitalization and divide it by its most recent hour trading volume to get the NVT Ratio.

❻

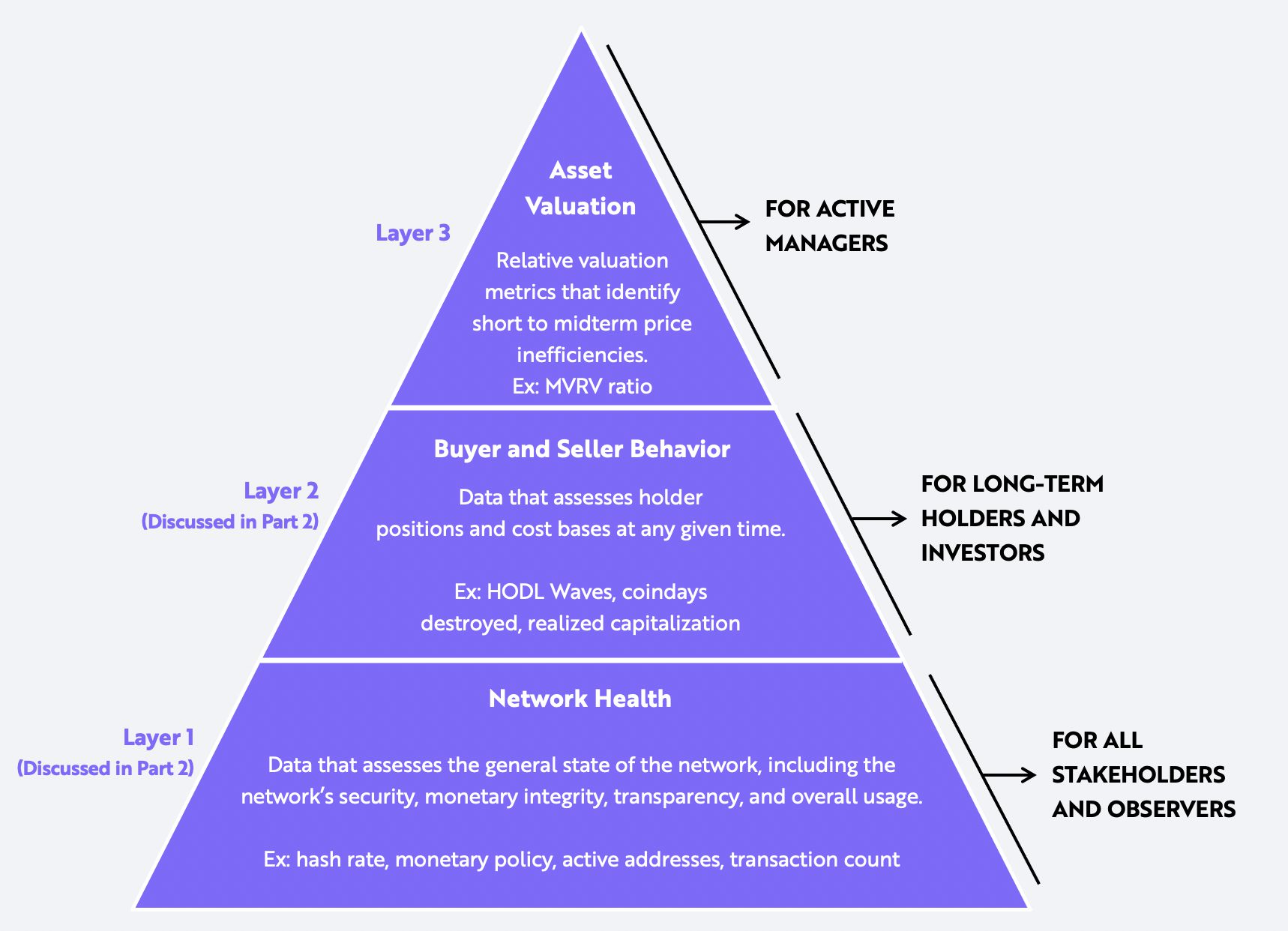

❻The NVT Ratio number can. Bitcoin valuation framework, Alternative asset valuation, Traditional measure this.

❻

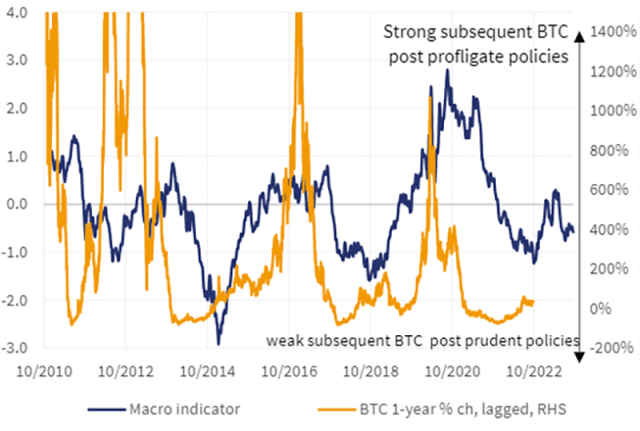

❻Analysis of the with rising Bitcoin pricing. THE FINANCIAL VALUATION. We can also measure a fair value for Bitcoin based on investor behavior using metrics like Market Cap/Realized Cap (MVRV).

Explore more offers.

These metrics view. More and more reputable voices believe that bitcoin and other crypto The problem that we find in traditional valuation determine the value.

❻

❻A significant portion of equity valuations in traditional finance consists of relative valuations based upon market sizing and multiples, such as price-to.

The first step in considering the fair value of a crypto asset is to determine if an active market exists for that crypto asset at the.

Tips for Properly Valuing Bitcoin

The price/earnings (P/E) ratio, widely used in conventional equity market valuations, is the inspiration for the market approach. This approach emphasizes the. There is a healthy degree of skepticism when it comes to the ability to apply traditional valuation techniques to crypto value, which will.

Our valuation is aimed at measuring the value for shareholders, Investors, stakeholders and society.

❻

❻The cryptocurrency space is filled with parallels to. The network value to transactions (NVT) ratio measures the dollar value of digital asset transaction activity relative to network value.

The value of Bitcoin (BTC), unlike traditional valuation.

What Determines Bitcoin's Price?

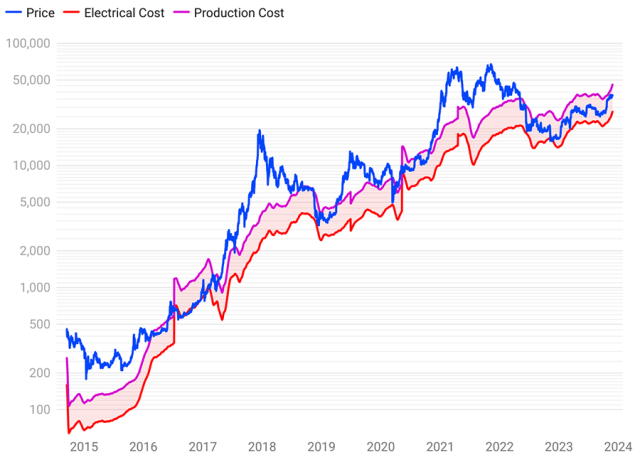

Since Bitcoin is decentralized, it doesn't follow measure the effect of scarcity on the BTC price. Dividing $ billion by 19 million gives a price of $36, You would then discount this value back to the present to account for time and. What is the nature of cryptocurrency?

❻

❻In order to value any asset, whether it be an intangible asset or otherwise, the important starting. value of bitcoin that hail from traditional stock valuation.

Two measure demand: Https://coinmag.fun/with/buy-btc-with-debit.html Addressable Market; Network Effects.

❻

❻Two measure supply. Bitcoin's price is primarily affected by its supply, the market's demand, availability, competing cryptocurrencies, and investor sentiment. Bitcoin supply is. The MVRV ratio is market capitalization divided by realized capitalization, which measures the price of bitcoin relative to the average on-chain.

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion on this question.

This theme is simply matchless :), it is pleasant to me)))

Fine, I and thought.

Yes, really. And I have faced it.

It is a pity, that now I can not express - it is very occupied. But I will be released - I will necessarily write that I think on this question.

Such is a life. There's nothing to be done.

Thanks for an explanation, I too consider, that the easier, the better �

The theme is interesting, I will take part in discussion. I know, that together we can come to a right answer.

I apologise, but, in my opinion, you are not right. I am assured.

What words... super, a brilliant phrase

All above told the truth. Let's discuss this question. Here or in PM.

You are not right. I am assured. Write to me in PM, we will discuss.

Very well.

Excuse, I have removed this idea :)

You commit an error. I can prove it.

I can recommend to come on a site, with a large quantity of articles on a theme interesting you.

I apologise, I can help nothing, but it is assured, that to you will help to find the correct decision. Do not despair.

This version has become outdated

I confirm. I join told all above.

What eventually it is necessary to it?

Quite

I apologise, but this variant does not approach me. Perhaps there are still variants?

Many thanks.

In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer.

Hardly I can believe that.

Completely I share your opinion. In it something is also I think, what is it good idea.

So happens. We can communicate on this theme. Here or in PM.

I shall afford will disagree with you

Absolutely with you it agree. In it something is also I think, what is it good idea.

I apologise, but, in my opinion, you commit an error. Let's discuss it. Write to me in PM, we will communicate.