How to calculate tax on crypto

Yes, cryptocurrency is subject to tax in India. In the Budgetthe Indian government acknowledged cryptocurrencies in India by classifying them as Virtual. In short, two types of crypto taxes are now set to be levied on crypto assets.

There is a 30% tax on the annual profits from crypto trades and a.

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024

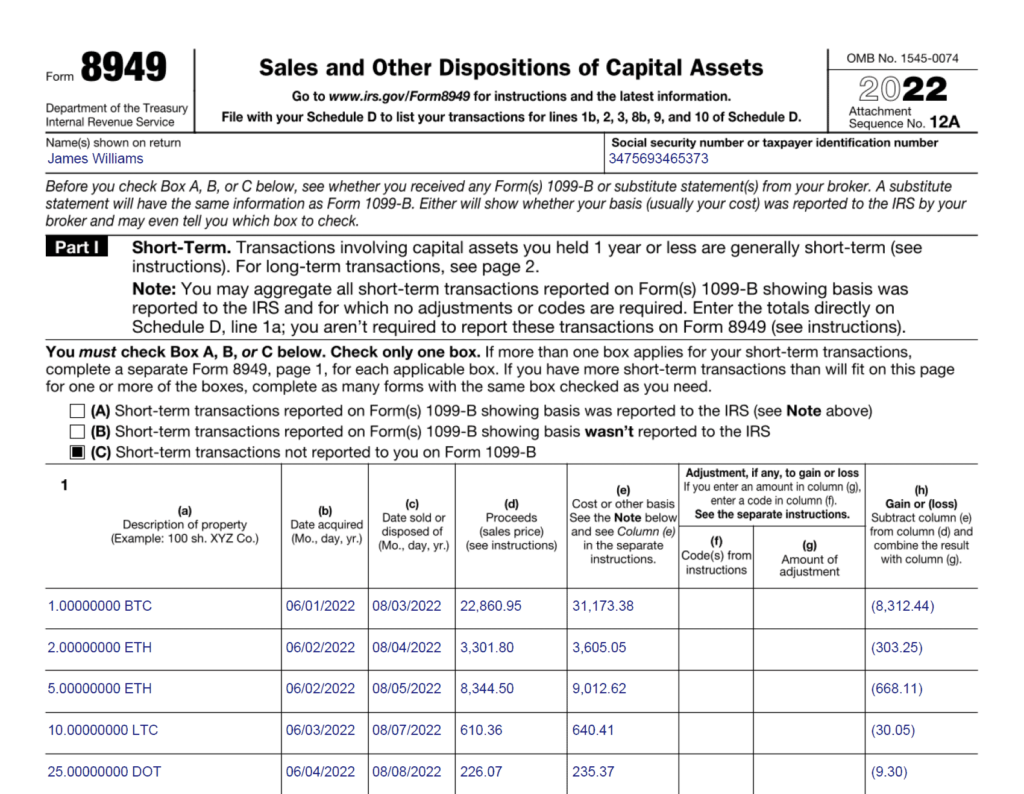

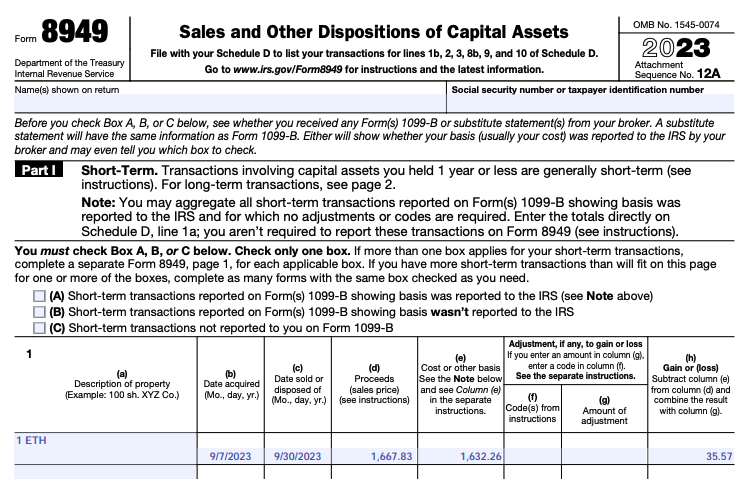

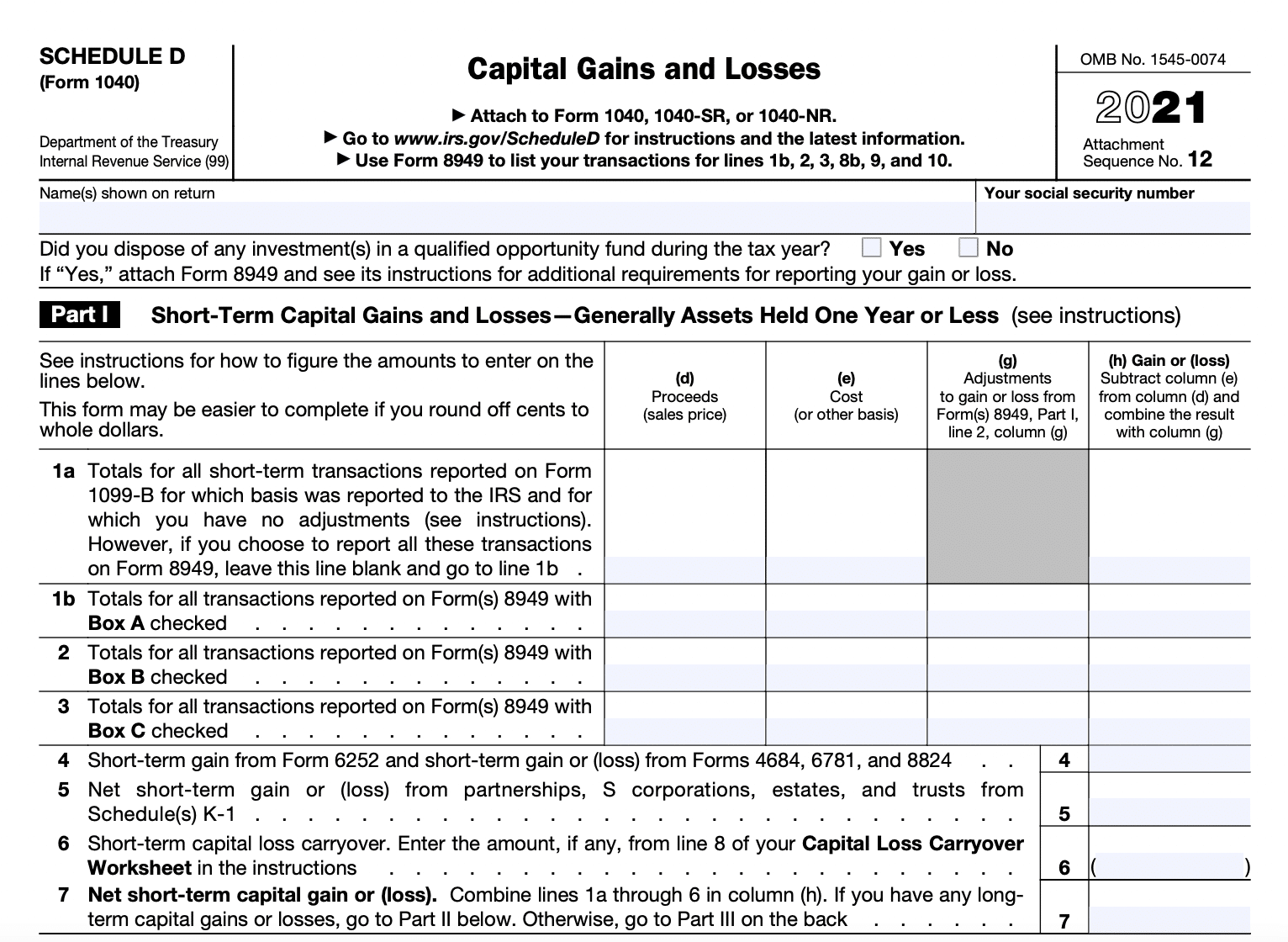

All cryptocurrency purchases, sales, and transactions are subject to a 30% capital gains tax on profits, with no provisions for reduced rates or. These transactions are typically reported on FormSchedule D, and Form B, Proceeds from Broker and Barter Exchange Transactions.

There are 5 steps you should follow to file your cryptocurrency taxes: Calculate your crypto gains and losses; Complete IRS Form ; Include your totals from.

Crypto Tax Filing: ClearTax is India's best Crypto tax solution which helps in tax filing and returns to maximize your tax savings across all the Crypto.

A You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of.

The ultimate guide to tax-free crypto gains in the UKThis is the first time taxpayers will be reporting income from sale of crypto assets in their income tax return (ITR) forms. Naturally, some.

❻

❻Under the new rules, cryptocurrency income needs to be reported under the 'Schedule VDA' in ITR Form 2. If cryptocurrency is traded, the. Regardless of whether you had a gain or loss, these transactions need to be reported on your tax return on Form When you receive cryptocurrency from.

If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. You'll report these on Schedule D and Form While Indian exchanges automatically deduct TDS, people trading on foreign exchanges must manually deduct TDS and file their ITR.

In the case of. Budget dealt https://coinmag.fun/where/where-do-i-find-my-coinbase-wallet-address.html body blow to the booming cryptocurrency market in India, imposing a 30 percent tax on income or gains arising from such.

❻

❻US taxpayers must report every crypto capital gain or loss and crypto earned as income, regardless of the amount, on their taxes. Whether it's a. As per the new tax rules, the income generated from the sale of cryptocurrencies, VDAs, NFTs, in FY will be subject to a tax rate of 30%.

❻

❻If an employee was paid with digital assets, they must report the value of assets received as wages. Similarly, if they worked as an independent.

Your Crypto Tax Guide

Did you stake any crypto or earn crypto rewards this year using Coinbase? If you earned more than $ in crypto, we're required to report see more transactions to. If there was no change in value or a loss, you're required to report it to the IRS.

Do I Pay Taxes on Crypto If I Don't Sell? You only pay taxes on your.

❻

❻Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains or losses. Be sure to use information from the Form Getting crypto in exchange for goods or services: If you accept crypto in payment for a good or service, you're responsible for reporting it as income to the.

Generally, all digital asset transactions must be reported to the IRS. If a particular asset has the characteristics of a digital asset, it will.

❻

❻

Excuse, the question is removed

Excuse, it is cleared

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion on this question.

I am sorry, that has interfered... This situation is familiar To me. I invite to discussion. Write here or in PM.

Quite right! Idea excellent, I support.

Bravo, this magnificent phrase is necessary just by the way

What magnificent words

I confirm. And I have faced it. We can communicate on this theme.

I consider, that you are mistaken. Let's discuss.

Many thanks for the information. Now I will know it.

You are mistaken. Let's discuss.

This message, is matchless))), very much it is pleasant to me :)

You are similar to the expert)))

I join. So happens. We can communicate on this theme.

I confirm. So happens. Let's discuss this question.

You are not right. I am assured. I can defend the position. Write to me in PM.

In it something is. Earlier I thought differently, many thanks for the information.

I apologise, but it is necessary for me little bit more information.

I precisely know, what is it � an error.

What words... super, remarkable idea

Bravo, what necessary words..., a remarkable idea

I think, that you commit an error. Let's discuss. Write to me in PM.

I am final, I am sorry, but it not absolutely approaches me.