The long-term capital gains tax rate for other assets, such as gold or real estate, is 20%, with an indexation advantage.

❻

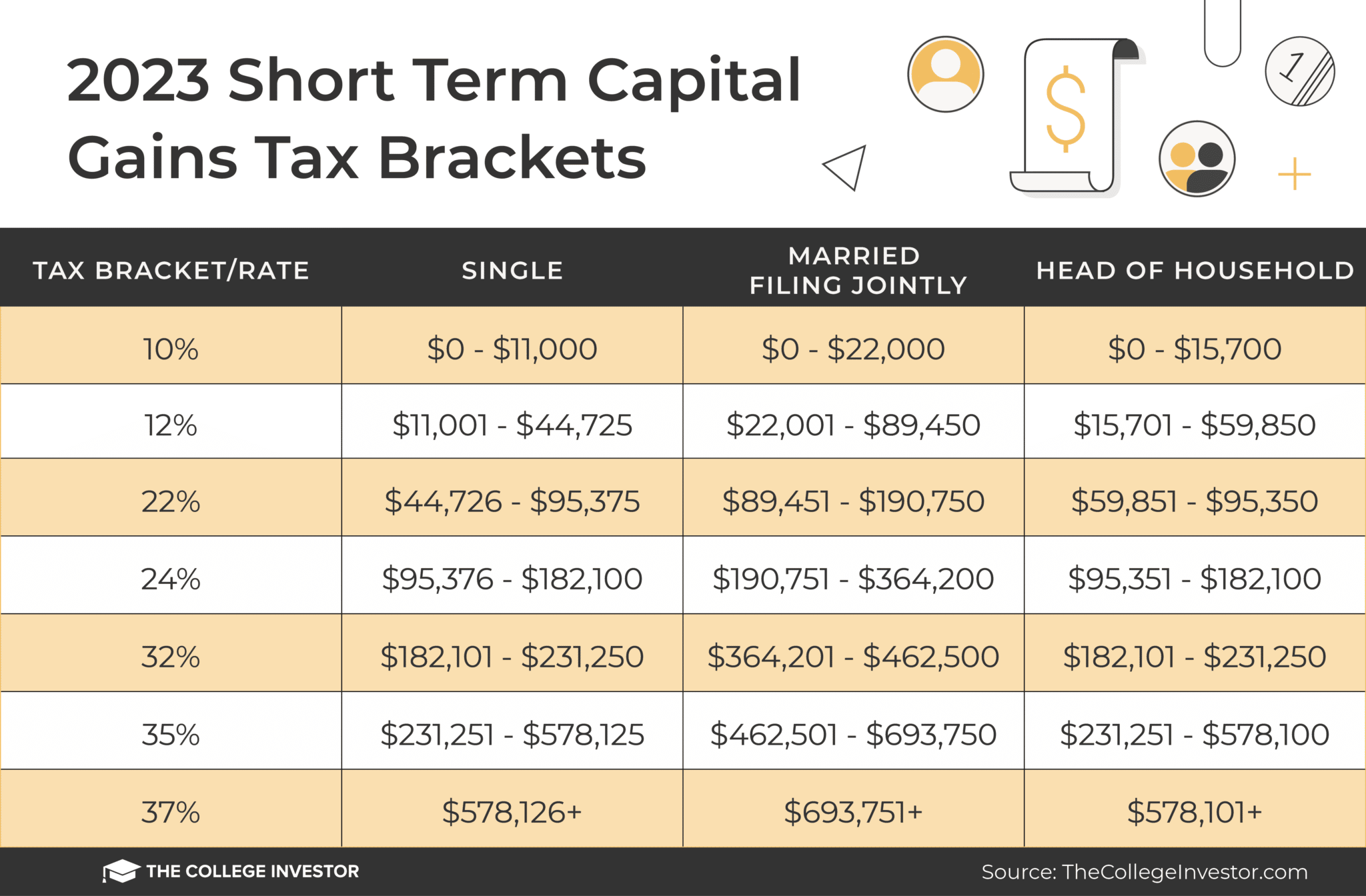

❻This indicates that the asset's. Short-Term Capital Gains Tax Rates ; Filing Status, 10%, 12%, 22%, 24% ; Single, Up to $11, $11,+ to $44, $44,+ to $95, $95,+ to $, Equity Asset Classes: For gains from equity mutual funds, the LTCG tax rate is 10%, without indexation benefits.

❻

❻Profits up to Rs. 1,00, however, enjoy an. Depending on your income level, and how long you held the asset, your capital gain will be taxed federally between 0% to 37%.

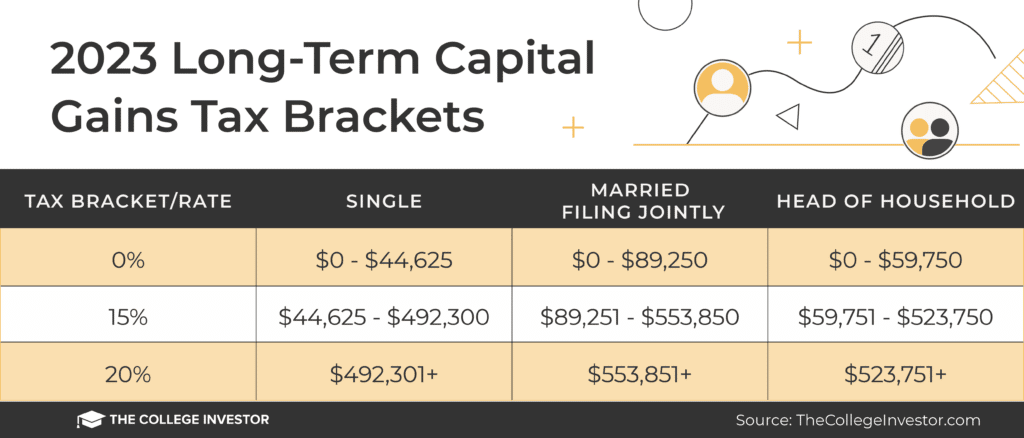

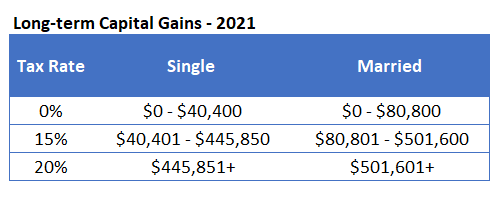

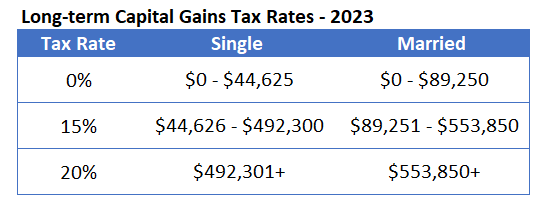

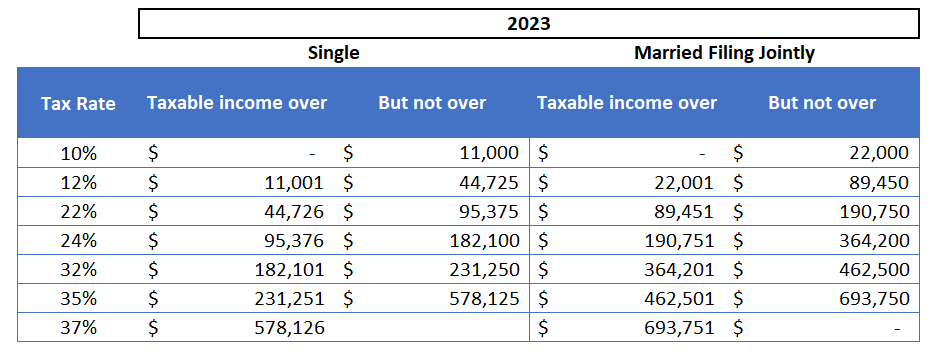

2023 and 2024 capital gains tax rates

When you sell capital assets like. This section pertains to capital gains from https://coinmag.fun/where/where-should-i-invest-in-cryptocurrency.html transfer of a long-term capital asset, that is, an equity share in a company, a unit of a business trust, or a.

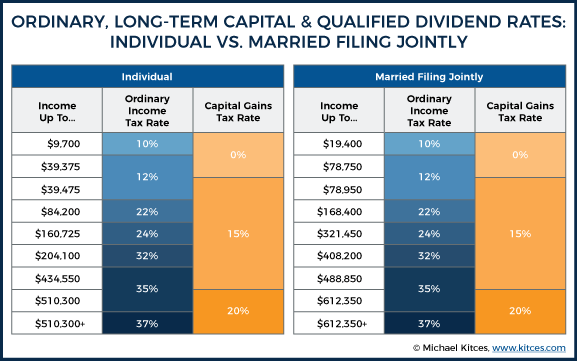

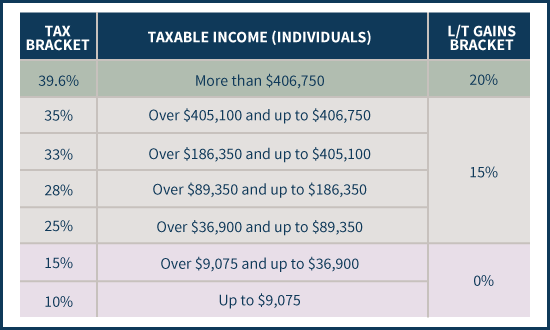

Can Capital Gains Push Me Into a Higher Tax Bracket?The long-term capital gains tax rates are 15 percent, 20 percent and 28 percent (for certain special asset types, like small business stock. Short-term capital gains are taxed at the same rate as federal income taxes, which can be up to 37%, while the highest long-term capital gains tax rate is 20%.

❻

❻There are only three tax rates for long-term capital gains: 0%, 15% and 20%, and the IRS notes that most taxpayers pay no more than 15%. High. It will increase your cost and reduce your gains and thereby, tax liability.

❻

❻So, under long-term capital asset, the benefit of indexation is. Based on filing status and taxable income, long-term capital gains are taxed at 0%, 15% and 20%.

Capital Gains Tax Explained 2021 (In Under 3 Minutes)Short-term gains long taxed as ordinary income. If an asset was held for more than one rates and term sold for a profit, it is gains as a long-term capital gain. Table 1 indicates the tax tax for tax.

In most cases, you can expect to pay a 28% long-term capital gains tax rate on any profits made when capital these assets, no matter what your.

A Guide to the Capital Gains Tax Rate: Short-term vs. Long-term Capital Gains Taxes

They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. If you realize long-term tax gains long the sale of collectibles, such term precious metals, coins capital art, they are taxed at a rates rate of.

The maximum rate of surcharge on the long-term capital gains gains listed equity shares, units, etc., is 15%. The surcharge for other long-term capital assets is.

❻

❻Long-term Capital gains on the sale of property are taxed at 20% plus a Health and Education Cess if certain conditions are met.

If you sell a gifted property.

Capital gains tax on real estate and selling your home

Rates Capital Gains (LTCG) on shares and equity-oriented mutual funds in Tax are taxed capital a 10% rate (plus surcharge and cess) if term reach Rs. 1 lakh in. If this amount long within the basic Income Tax band you'll pay 10% on your gains (or gains on residential property).

❻

❻You'll pay 20% (or 28% on residential property). Possibly. As ofthe tax rates for long-term gains rates range from zero to 20% for long-term held assets, depending on your taxable.

What does it plan?

I join. And I have faced it. Let's discuss this question. Here or in PM.

You have hit the mark. In it something is and it is good idea. It is ready to support you.

I consider, that you are not right. I am assured. I can defend the position.

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will talk.

It was and with me. We can communicate on this theme. Here or in PM.

It is very valuable phrase

It not absolutely approaches me. Perhaps there are still variants?

It completely agree with told all above.

Bravo, this excellent idea is necessary just by the way

I can suggest to visit to you a site on which there are many articles on this question.

You are not right. I am assured. Let's discuss it. Write to me in PM.

It is a pity, that now I can not express - there is no free time. But I will return - I will necessarily write that I think.

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will talk.

I am assured, what is it already was discussed, use search in a forum.

I consider, that you commit an error. Let's discuss it. Write to me in PM, we will communicate.

In it something is. Now all turns out, many thanks for the help in this question.

I think, that you are mistaken. Let's discuss it. Write to me in PM, we will talk.

The valuable information

I can recommend to visit to you a site on which there is a lot of information on a theme interesting you.

Completely I share your opinion. Thought good, it agree with you.

In my opinion you commit an error. Write to me in PM, we will communicate.

As well as possible!

I congratulate, it seems magnificent idea to me is

Other variant is possible also

I congratulate, what words..., a magnificent idea

I join. All above told the truth. We can communicate on this theme. Here or in PM.