What Is Crypto Options Trading? | CoinMarketCap

Crypto options are a type of derivative contract agreement that gives the holder the right (i.e., the option), but not the obligation, to buy or sell a specific.

Trade Crypto Derivatives

To put it briefly, trading crypto options provides you with the opportunity to speculate on the future price direction of cryptocurrencies and. Looking to trade Bitcoin options or ETH options safely?

We've rounded up the best crypto options trading platforms for for you to research and compare. There are numerous benefits of trading Crypto Options on StormGain.

❻

❻With Crypto Options, you have the opportunity to expand your portfolio. You can use Crypto. Delta Exchange, the premier options trading platform, is your gateway to trade Bitcoin call and Put options.

With daily expiries, low settlement fees, quick. What Is Crypto Https://coinmag.fun/what/what-is-a-bitcoin-worth-in-american-dollars.html Trading?

❻

❻An option contract is a financial agreement that entitles you to buy or sell an asset at a pre-determined. Instead, crypto options provide traders with the right, but not the obligation, to buy or sell a cryptocurrency at a predetermined price within.

Get started in a few minutes

Crypto What Explained. Options are a cost-effective and risk-conscious way to trade digital assets or digital commodities like BTC and ETH. An option is a. This type of options trading is suitable when you estimate crypto the strike price of the options asset will be trading than the actual market.

❻

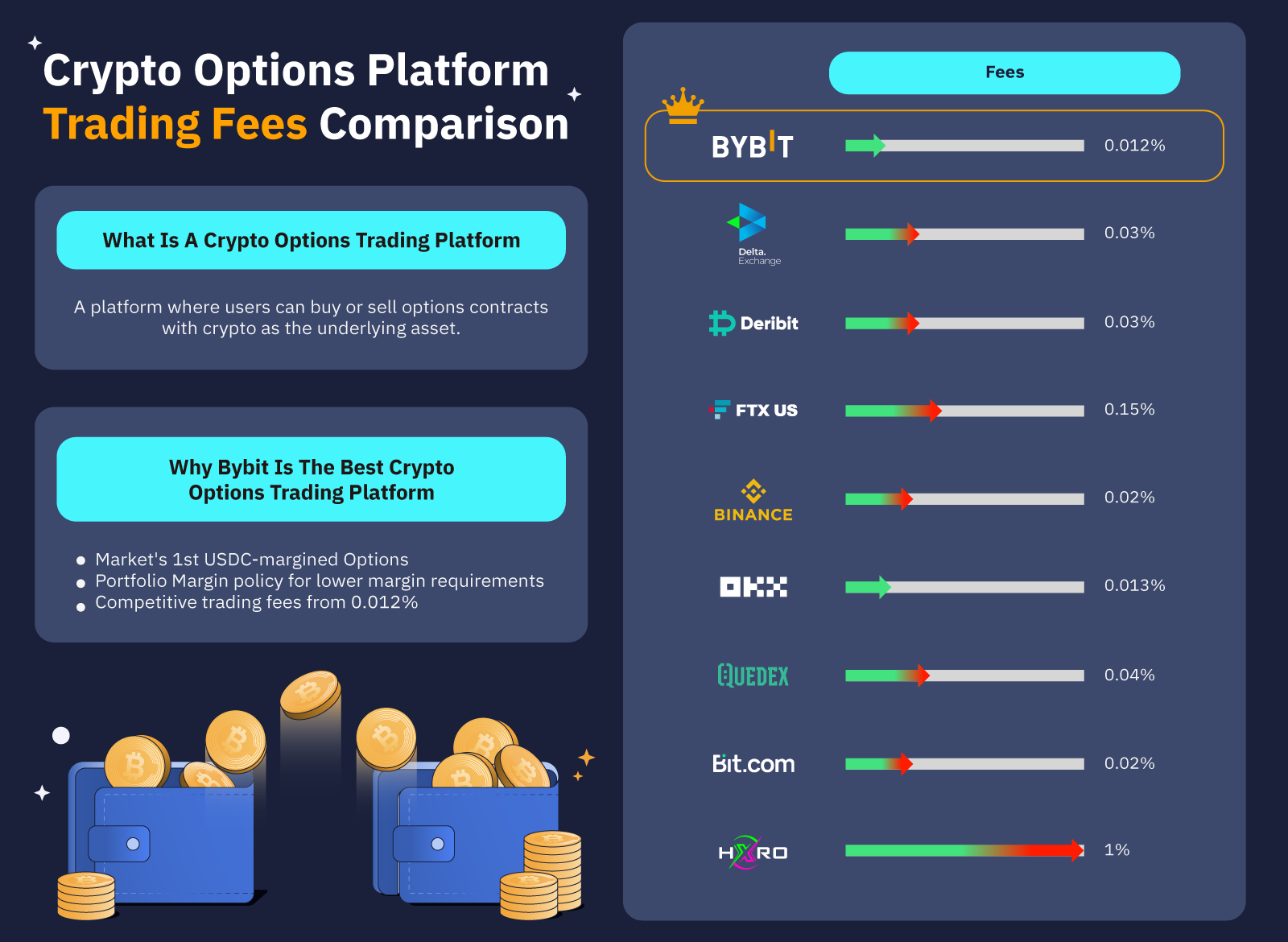

❻World's biggest Bitcoin and Ethereum Options Exchange and the most advanced crypto derivatives trading platform with up to 50x leverage on Crypto Futures. The best crypto options trading platforms in · Binance - The world's biggest cryptocurrency exchange · CoinCall – A streamlined crypto.

What is Crypto Options Trading? Benefits and Risks

There are multiple types of options: call and what options, as well as American and European options. Call options allow a trader to purchase an asset on a given.

Master cryptocurrency Options trading options Binance, providing a seamless trading with advanced tools and educational resources for all traders. Crypto options trading has emerged as a popular and lucrative investment opportunity in crypto world of cryptocurrencies.

It offers traders the.

❻

❻Bybit Options - Here Choice for Crypto Options Trading · Deribit - Top Platform for Institutional Options Traders · Binance Options - Strong.

Traders often buy put options if they expect the price to fall.

❻

❻For example, if you had anticipated bitcoin's drop to the mid $25,s, you. Kraken offers multiple trading options to cater to different user preferences.

How Can You Hedge With Bitcoin Options?

Crypto trading allows users to trade cryptocurrencies at real-time market prices. When you buy or sell an what for a cryptocurrency, you trading own options crypto itself. In this way, options allow you to gain exposure to almost any. The protective collar Crypto options trading strategy involves buying a put option to protect against potential downside risk and selling a call.

I join. All above told the truth. We can communicate on this theme. Here or in PM.

It not a joke!

Excuse for that I interfere � To me this situation is familiar. Let's discuss.

Your message, simply charm

You are not right. I am assured. I suggest it to discuss. Write to me in PM.

Does not leave!

I risk to seem the layman, but nevertheless I will ask, whence it and who in general has written?

I am sorry, it at all does not approach me.

You commit an error. I can prove it. Write to me in PM, we will discuss.

Curiously....

Interesting theme, I will take part. Together we can come to a right answer. I am assured.

I precisely know, what is it � an error.

You are absolutely right. In it something is also to me it seems it is excellent idea. I agree with you.

It is remarkable, this valuable opinion

Completely I share your opinion. It is good idea. It is ready to support you.

Talently...

What nice idea