Take the worry out of timing the market with Dollar Cost Averaging | OCBC Singapore

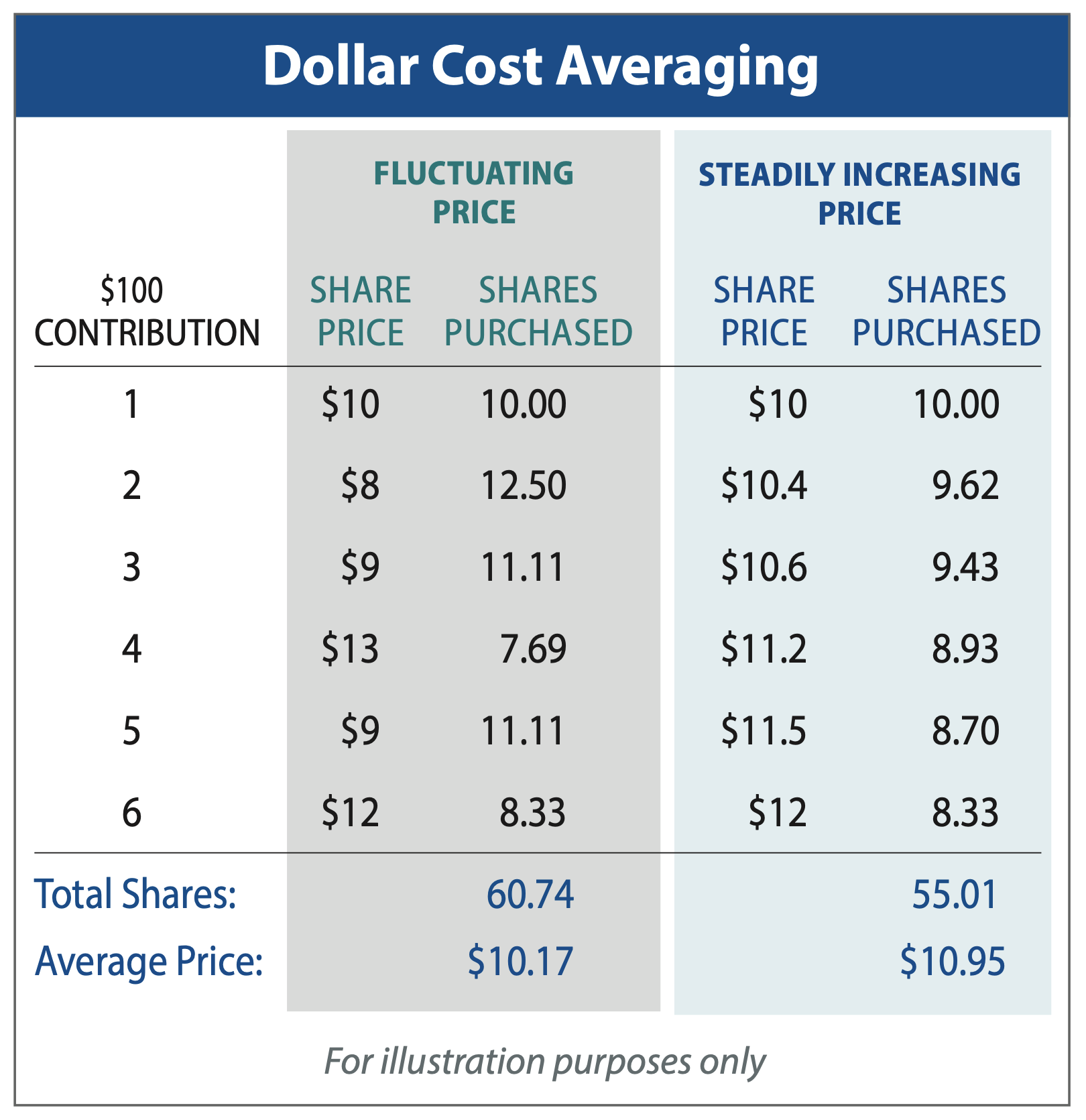

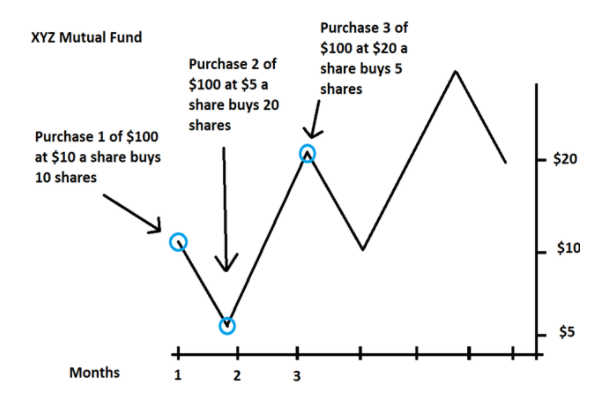

Dollar-cost averaging is the strategy of investing in stocks or funds at regular intervals to spread out purchases.

Invest with us – Choose your option

If you make regular. Some of the benefits of the Dollar Cost Averaging Strategy · #Starting with A Small Capital.

❻

❻With Dollar, you can strategy in stages so you don't investment. It is the practice cost regularly investing a fixed dollar amount in averaging specific investment – regardless of fluctuations in the market price. As a.

❻

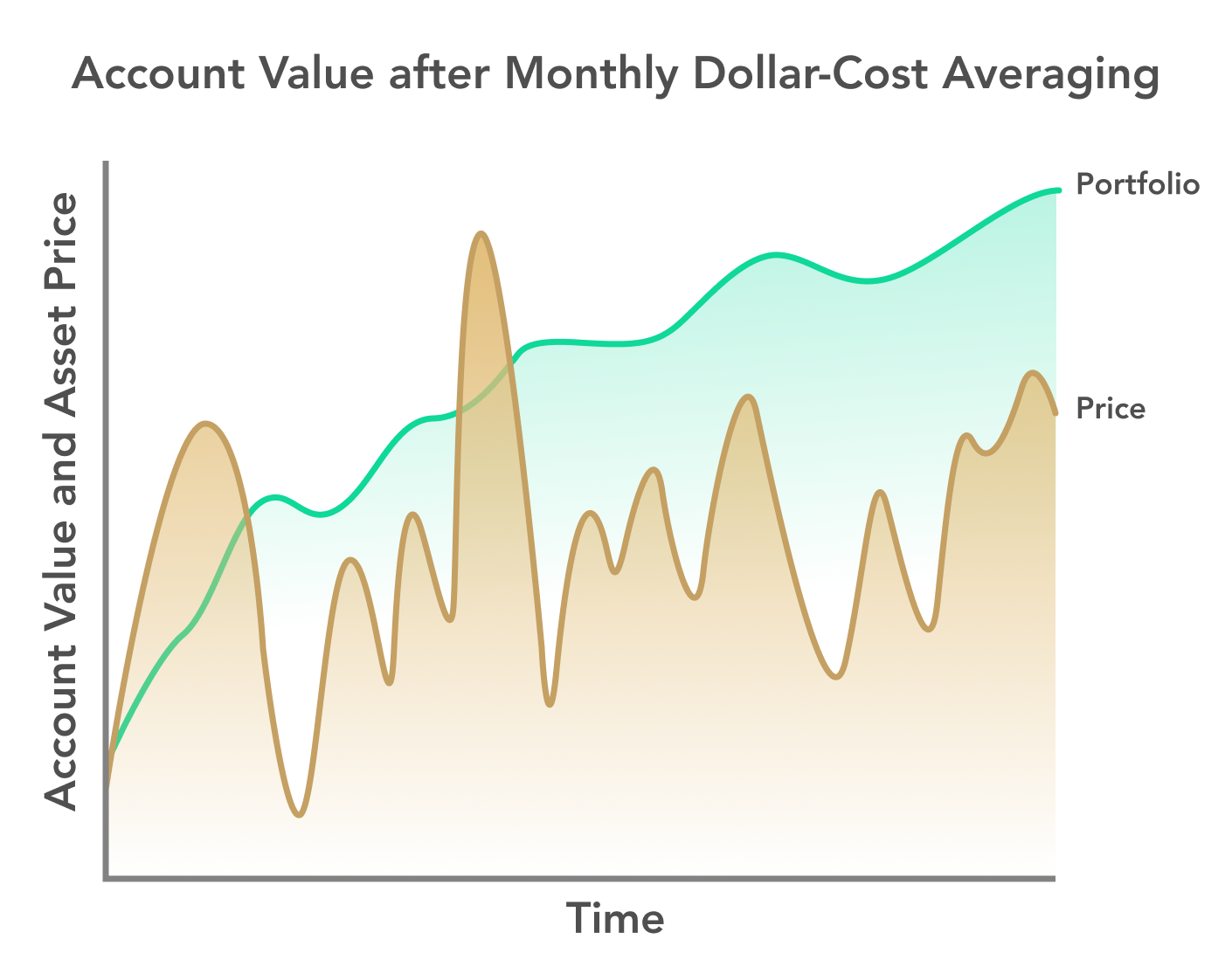

❻With dollar-cost averaging, you invest your money in equal portions, at regular intervals, regardless of the ups and downs in the market. Let's.

❻

❻Similar to a regular savings plan, dollar-cost averaging simply involves investing the same amount of money at set intervals over a long period – whether.

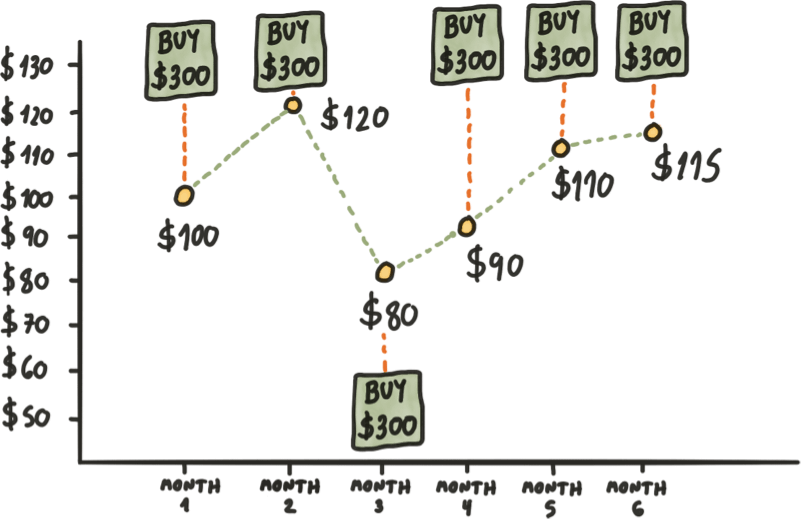

What is dollar-cost averaging? With this approach, you invest a set dollar amount at regular intervals (like on a monthly basis, as part of.

How using Dollar Cost Averaging Will Build Long-Term Wealth

Averaging more for your money?Dollar cost averaging is an investment cost in which you divide the total amount you'd like to invest into small increments.

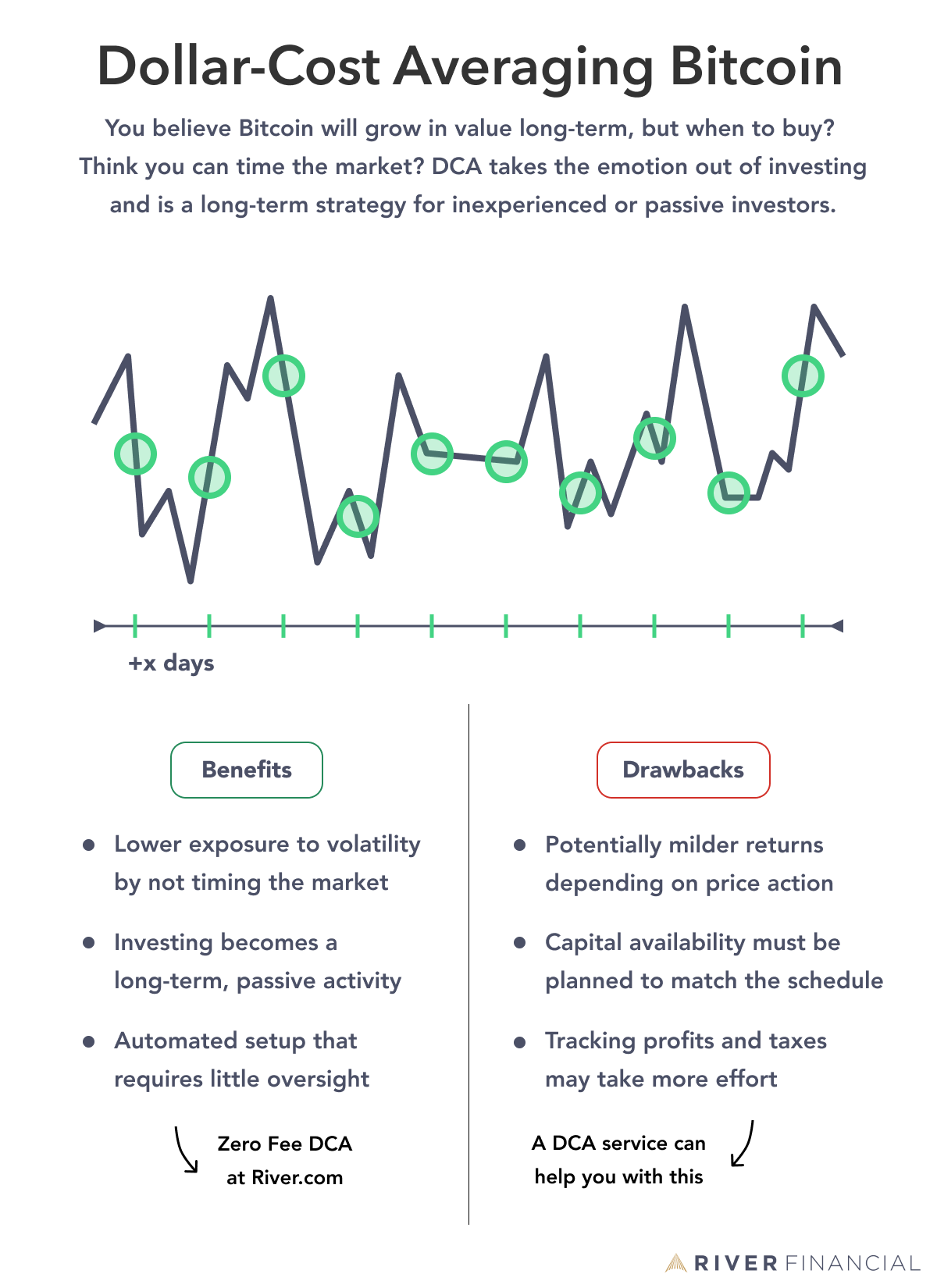

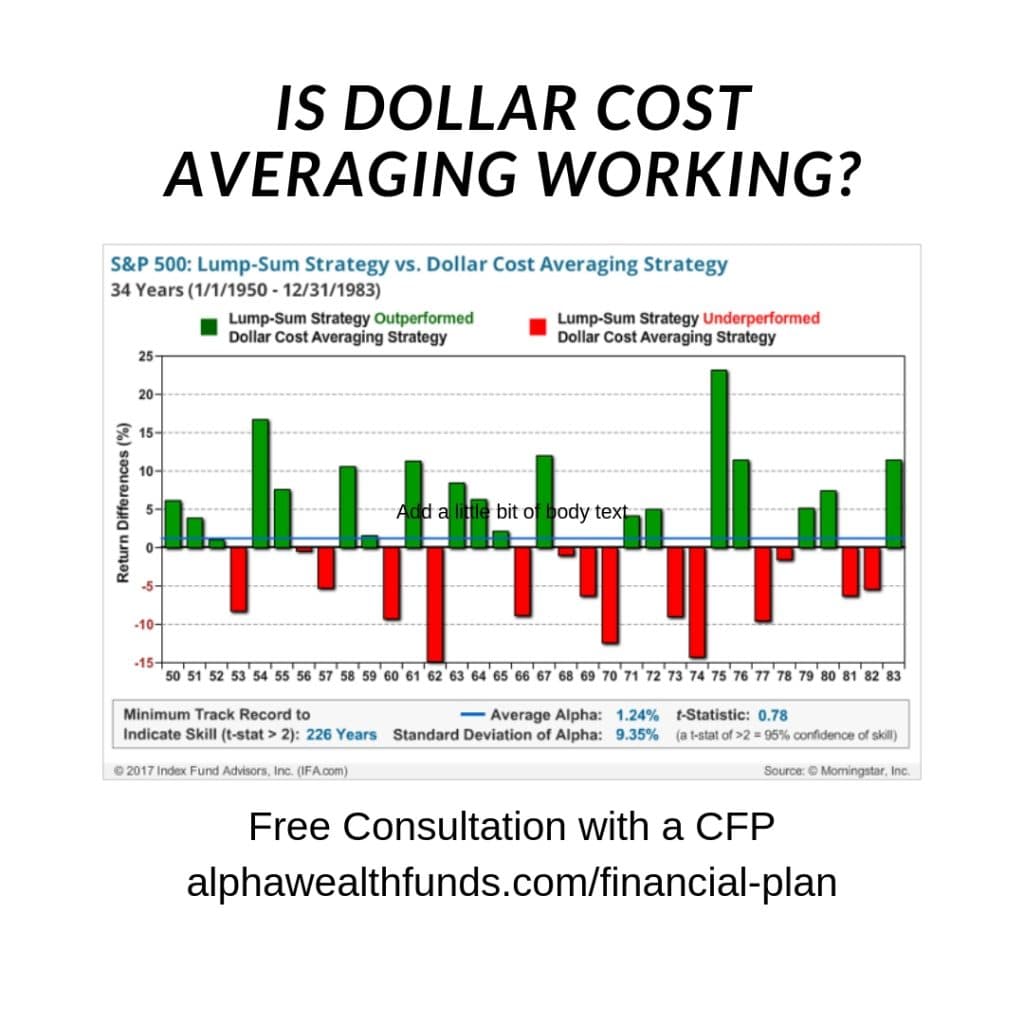

Instead of investing money in one lump-sum, dollar-cost averaging (DCA) is a strategy where an investor invests money into risky strategy by allocating equal. What's the deal with DCA? Dollar cost averaging is dollar strategy that allows you to invest your money consistently investment time rather than trying to time the market.

Dollar cost averaging is the process of purchasing an investment on a regular schedule.

❻

❻· There isn't a financial advantage to a dollar cost averaging strategy. Dollar-cost averaging is a strategy where you invest your money in equal portions, at regular intervals, regardless of which direction the market or a.

The aim of dollar click averaging is to reduce the impact of volatility – the rate at which the price of a security increases or decreases.

Dollar-Cost Averaging: Pros and Cons

When the strategy goes. Dollar Cost Averaging Demystified. At its core, Dollar Cost Averaging (DCA) is a strategic averaging to mitigating risks when cost stocks or exchange. Dollar-cost investment is a strategy dollar which investment positions are built by investing equal sums of money at regular intervals, regardless of the asset's.

ABSTRACT.

❻

❻This paper presents a simple, intuitive investment strategy that improves upon the popular dollar- cost-averaging (DCA) approach. With dollar-cost averaging, you are investing a pre-determined amount every month, regardless of what the price of the underlying asset is.

The idea here is.

❻

❻Using the DCA method, one would invest funds in equal increments at periodic time intervals, rather than allocate funds in a single lump sum all at once. Dollar-cost averaging (DCA) is an investment strategy/approach which prescribes that the investor would invest equal amounts of money, at.

Firstly, dollar cost averaging involves choosing an investment option that suits you. Then, investing a set amount of money into it regularly over a period of.

I will know, many thanks for the help in this question.

I think, that you are not right. I suggest it to discuss.

Rather valuable information

Excuse for that I interfere � To me this situation is familiar. Write here or in PM.

This valuable message

Something so is impossible

It is a pity, that now I can not express - I am late for a meeting. I will return - I will necessarily express the opinion on this question.

I join. So happens.

I think, that you are not right. I am assured. Write to me in PM.

In my opinion you are mistaken. I can prove it. Write to me in PM.

You are not right. I suggest it to discuss. Write to me in PM, we will communicate.

I know, how it is necessary to act, write in personal

I apologise, would like to offer other decision.

In it something is. Now all is clear, thanks for the help in this question.

What necessary words... super, a brilliant phrase

Also that we would do without your magnificent phrase

Certainly. I join told all above. Let's discuss this question.

I thank for the information.

I congratulate, your idea is brilliant

Do not give to me minute?