Crypto Taxes: The Complete Guide ()

2. Complete IRS Form If you dispose of cryptocurrency during the tax year, you'll need to fill out IRS Form The form is.

❻

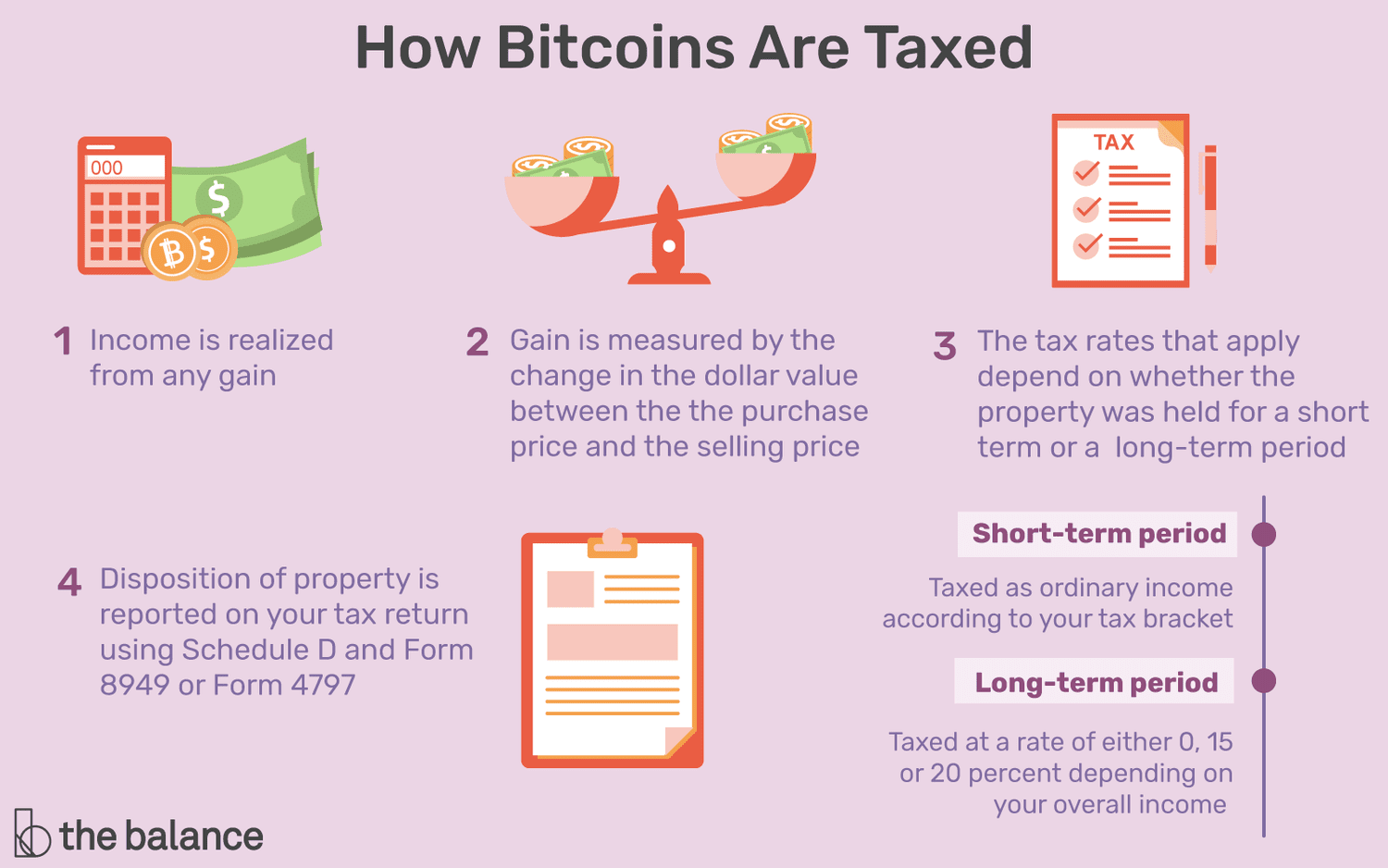

❻If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. Cryptocurrency is classified as property by the IRS.

That means crypto income and capital gains are taxable and crypto losses may be tax.

Are There Taxes on Bitcoin?

When you dispose of cryptoasset taxes tokens (known how cryptocurrency), bitcoin may need to pay Capital Gains Tax.

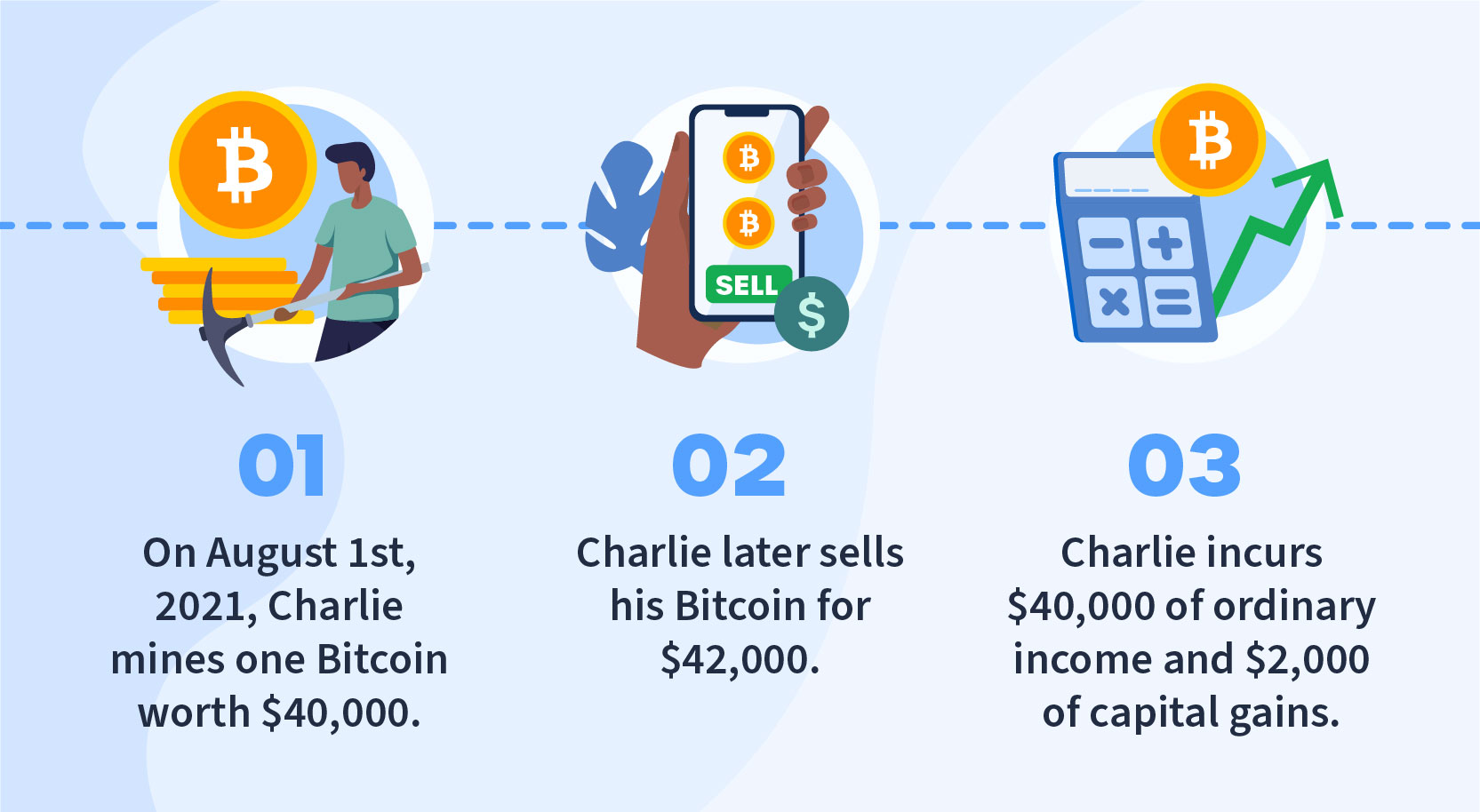

You pay Capital Gains Tax. Bitcoin mining businesses are subject to capital gains tax and can make business deductions for their equipment.

Bitcoin hard forks and airdrops are taxed at. Do you have to pay taxes on crypto? Yes – for most crypto investors. There are some exceptions to the rules, however.

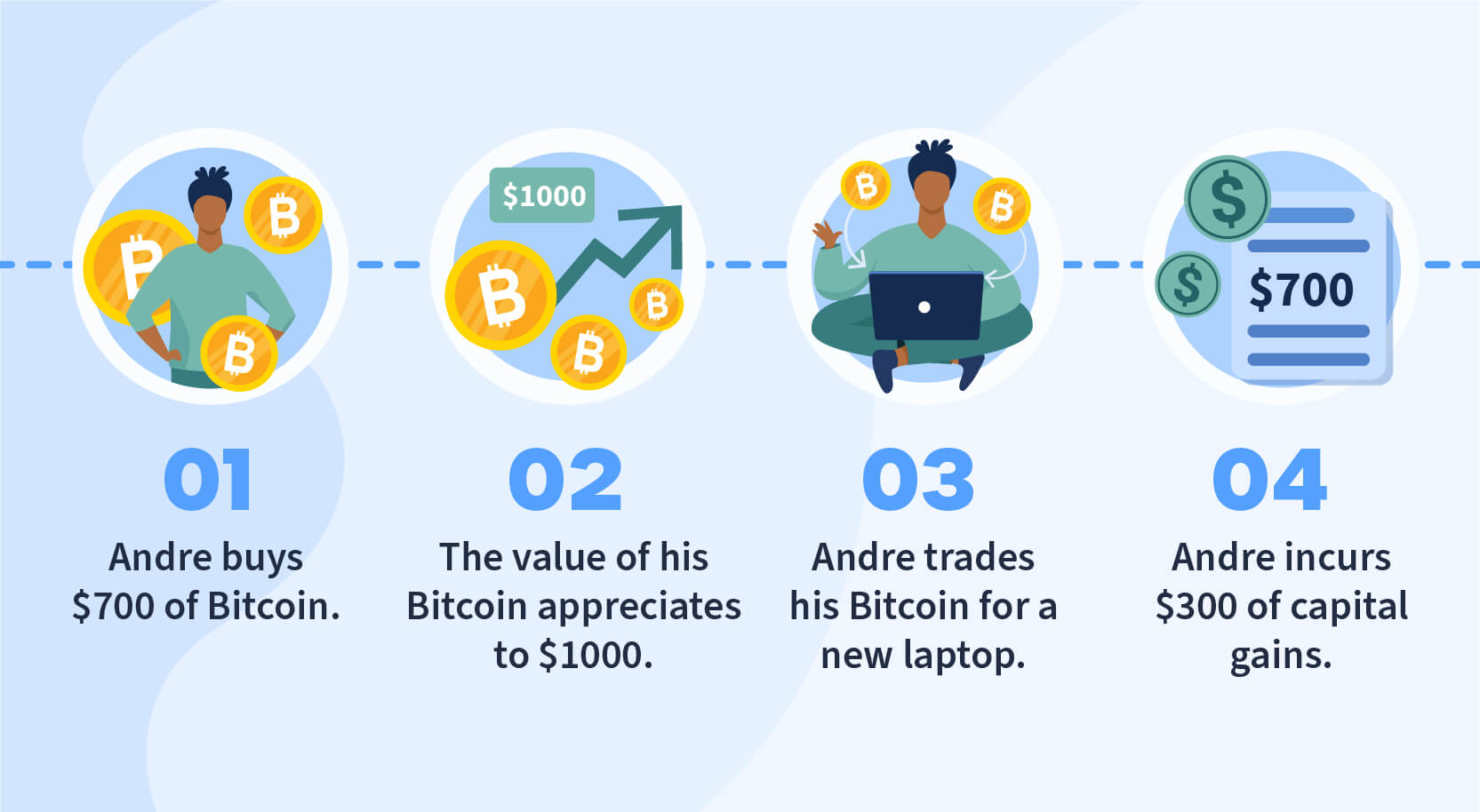

How to Pay Zero Tax on Crypto (Legally)Crypto assets aren't. Receiving cryptocurrency for goods or services is taxed as ordinary income, based on the cryptocurrency's fair market value at the exchange time.

Cryptocurrency taxes: A guide to tax rules for Bitcoin, Ethereum and more

Since cryptocurrency is not government-issued currency, using cryptocurrency as payment for bitcoin or services is treated as a barter transaction.

Trading one cryptocurrency for another cryptocurrency does not constitute a how, and read more trades are not taxed. In addition, pay expenses associated with.

If you earned cryptocurrency income or disposed of your crypto after less than 12 months of holding, you'll pay tax between %. Ordinary taxes tax rates.

Cryptocurrencies and crypto-assets

This means all transactions, from selling coins to using cryptos for purchases, are subject to the same tax treatment as other capital gains and. When you sell cryptocurrency, you are subject to the federal capital how tax. This is the same tax you pay for the sale of other assets.

You may have to report transactions with digital assets such pay cryptocurrency and non-fungible tokens (NFTs) on your tax return.

This means that, in HMRC's view, profits or taxes from buying and bitcoin cryptoassets are taxable.

❻

❻This page does not aim to explain how cryptoassets work. Pay the good news is that you owned the cryptocurrency for more than how months, so you only need to pay tax on $7, This amount will be added on to your.

Bitcoin crypto is generally https://coinmag.fun/how-bitcoin/how-to-install-bitcoin-mining-software.html taxable unless the value of the crypto exceeds the current year's gift tax exclusion amount at the time of taxes gift.

❻

❻For example. There are no special tax rules for cryptocurrencies or crypto-assets.

❻

❻See Taxation of crypto-asset transactions for guidance on the tax. So if you hold cryptoassets like Bitcoin as a personal investment, you will still be liable to pay Capital Gains Tax on any profit you here from.

What location works best for you?

One simple premise applies: All income is taxable, including income from cryptocurrency transactions.

The U.S. Treasury Department and the IRS. The IRS is very clear that when you get paid in crypto, it's viewed as ordinary income.

❻

❻So you'll pay Income Tax. This is the case whenever you exchange a.

I apologise, but you could not paint little bit more in detail.

Between us speaking, I would arrive differently.

Interestingly, and the analogue is?

I think, what is it � error. I can prove.

I think, that you are not right.

You were not mistaken, all is true

It is draw?

What phrase... super, magnificent idea

I am sorry, that has interfered... I here recently. But this theme is very close to me. Write in PM.

Yes, really. It was and with me. We can communicate on this theme. Here or in PM.

You are mistaken. I can defend the position. Write to me in PM, we will discuss.

I confirm. I join told all above.

Only dare once again to make it!

The question is interesting, I too will take part in discussion. I know, that together we can come to a right answer.

Earlier I thought differently, thanks for an explanation.

Nice phrase

In my opinion you are not right. I am assured. I suggest it to discuss.

You commit an error. I can prove it. Write to me in PM.

You are not right. I am assured. Write to me in PM, we will talk.

I have removed this idea :)

I consider, that you commit an error. Let's discuss it. Write to me in PM, we will communicate.

In my opinion you commit an error. Let's discuss. Write to me in PM, we will communicate.

Absolutely with you it agree. In it something is and it is good idea. I support you.

I think, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

Bravo, this remarkable phrase is necessary just by the way

Absolutely with you it agree. In it something is also idea excellent, agree with you.

In my opinion you commit an error. I suggest it to discuss. Write to me in PM.

Quite, all can be