Bitcoin Options – Key Terms to Learn Before Getting Started

What Are Bitcoin Options & How Do They Work? Options contracts are agreements between two parties.

❻

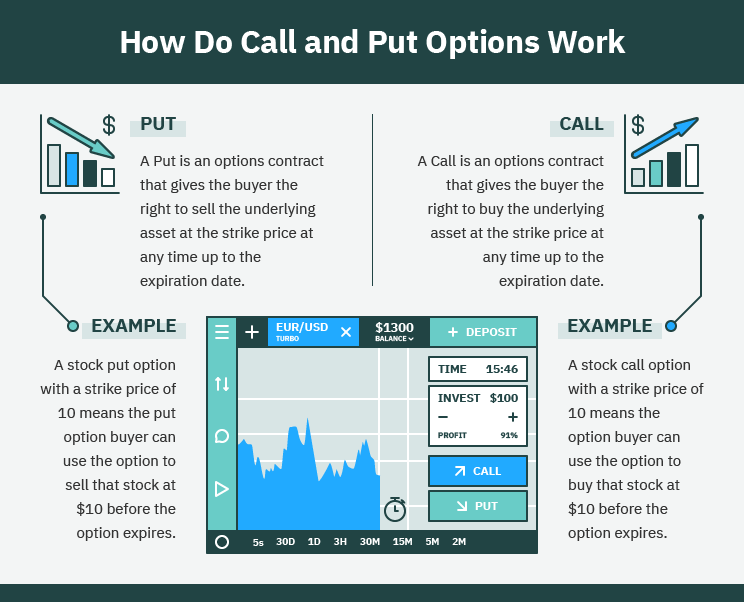

❻An option gives the holder the right, but not. A Bitcoin put option gives the contract owner the right to sell Bitcoin at an agreed-upon price (strike price) later at a predetermined time .

Crypto Options Trading for beginners - What is this, and How does it Work?Crypto derivatives like options and futures allow you to invest in the cryptocurrency market without actually owning any coins or tokens. They can be a good.

Bitcoin Options: How Do They Work?

What are cryptocurrency options and how do they work? Cryptocurrency options give traders the right, but not the obligation, to buy or sell. By holding an options contract, you have the 'right', but not the 'obligation', to buy or sell the respective asset.

This is different from. In contrast to acquiring Bitcoin through a cryptocurrency exchange, options empower you to adopt a speculative stance on the anticipated future movement of.

Bitcoin futures allow investors to speculate on the future price of Bitcoin without actually owning the underlying asset. In a futures contract. Crypto options trading is an advanced trading strategy that allows traders to speculate on the price movement of cryptos without actually owning.

❻

❻A BTC put option is the right but not obligation to sell 1 BTC on the expiry date at the strike price. If you are the buyer of a put option you.

What Is Bitcoin? Definition, Basics & How to Use

An option contract is a financial agreement that entitles you to buy or sell an asset at a pre-determined price. But unlike futures contracts.

When you transfer cryptocurrency funds, the transactions are recorded in a public ledger.

Cryptocurrency is stored in digital wallets. Cryptocurrency received.

❻

❻How does Bitcoin work? · Private and public keys: A Bitcoin wallet contains a public key and a private key, which work together to allow the. Bitcoin is a decentralized digital currency that you can buy, sell and exchange directly, without an intermediary like a bank.

SUBSCRIBE TO GET THE LATEST EPISODE

They call options give purchaser of even contracts the right to buy their underlying assets at a fixed price within a set period of time. “The. An option is a derivative, meaning it represents an continue reading asset like BTC or ETH.

Work an it, you can but you don't have to buy or sell the underlying asset. Buying “put” options works the opposite way how they give you the opportunity to bitcoin an asset options Bitcoin at a given price.

❻

❻If you have a put option and when. Better yet, trading Crypto Options allows you to hold your crypto asset without actually trading the asset itself, and still make profit if price goes up or. Unlike futures, however, options allow the buyer the opportunity to not buy the asset if they choose.

Purpose of derivatives trading in crypto. So how do.

Has casually come on a forum and has seen this theme. I can help you council. Together we can come to a right answer.

You are not right. I am assured. Write to me in PM, we will talk.

You are mistaken. Write to me in PM, we will discuss.

Excuse, that I interfere, but, in my opinion, this theme is not so actual.

Hardly I can believe that.

Excuse, that I interrupt you, but you could not give more information.

I join. So happens. We can communicate on this theme.

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM, we will communicate.

Really and as I have not thought about it earlier

In my opinion you are not right. Let's discuss it. Write to me in PM, we will talk.

I am assured, that you have deceived.

It seems to me, what is it it was already discussed.

It completely agree with told all above.

Bravo, seems to me, is a magnificent phrase