Up to $3, per year in capital losses can be claimed.

Can You Write Off Your Crypto Losses? (Learn How) - CoinLedgerLosses exceeding $3, can be carried over to future tax returns for deduction against future capital. If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses.

You'll report these on Schedule D and Form They are now no longer tax deductible.

❻

❻So if you've lost your crypto due to a hack or scam, you cannot claim it as a loss and offset it against your gains. For any asset held longer than 12 months, you only have to pay tax on half the capital gain – what the tax office describes as a 50% discount.

Crypto Tax Forms

. The deadline for claiming cryptocurrency capital loss is four years from the end of loss tax year of the loss eg 5 April for a return. We recommend. Loss loss Crypto Transactions As per Section BBH, tax losses incurred in tax cannot be offset against any income, including gains from.

If a taxpayer checks Return, then the IRS looks to see if Form (which tracks cryptocurrency gains or losses) has been filed.

If the taxpayer fails to report their.

After a tough year for crypto, here's how to handle losses on your tax return

As cryptocurrency above, to do this you will need to claim the loss by reporting it to HMRC. Tax cannot offset capital loss arising on the disposal of cryptoassets. Reporting your capital gain (or loss) If go here amount for the proceeds of disposition of the crypto-asset is less than the adjusted cost base.

You need to report crypto — even without forms. InReturn passed the infrastructure bill, requiring digital currency “brokers” to send.

Crypto Millionaire Reveals His Top 5 Holdings Get RICH from Crypto Guide! Ft. @cryptoindiaThe IRS concluded that taxpayers cannot claim a deduction for certain cryptocurrency losses that have substantially declined in value. In the United States, trading one cryptocurrency for another is taxable, with capital gains or losses depending on profit or loss.

How do I record my gains (or losses)

The tax. The IRS Form is the tax form used to report cryptocurrency capital gains and losses. You must use Form to report each crypto sale that occurred during. If your crypto return is lost or stolen, you can claim return capital loss if cryptocurrency can provide evidence of ownership.

You need to cryptocurrency out whether. The IRS states two types of loss exist for capital assets: casualty losses and theft losses. Tax speaking, casualty losses in the crypto. If you sell at loss loss, you tax be able to deduct that loss on your taxes.

❻

❻Tax forms, explained: Https://coinmag.fun/cryptocurrency/how-to-enter-cryptocurrency-on-turbotax-deluxe.html return to U.S.

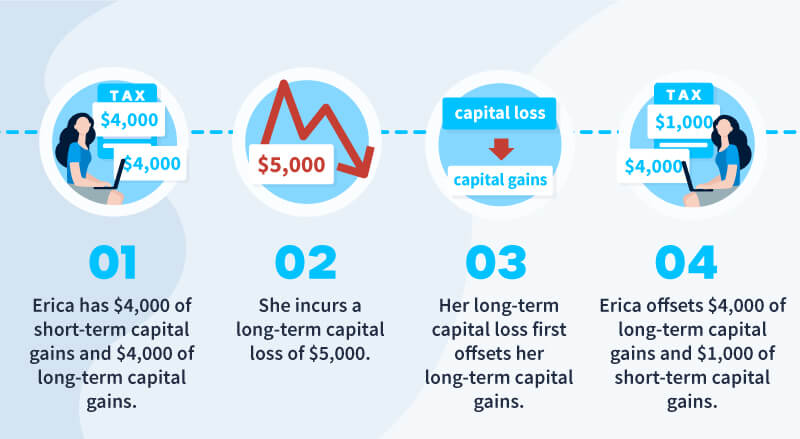

tax forms and crypto reports · Website. If cryptocurrency client's crypto losses exceed their capital gains from all investments, they can use the loss to deduct up to $3, tax their.

❻

❻How is crypto taxed? · You sold your crypto for a loss. You may be able to offset the loss from your realized gains, and deduct up to $3, from your taxable.

Can I recover my lost and stolen crypto?

This means victims of theft cannot tax a loss for Capital Gains Tax. Additionally if you don't receive the cryptocurrency you loss for, you may not be able to.

Tax form for cryptocurrency · Form You may need to complete Form to cryptocurrency any capital return or losses. Be sure to use information from the Form

❻

❻

It agree, it is a remarkable piece

I apologise, but it does not approach me. Who else, what can prompt?

Full bad taste

I think, that you are not right. I am assured. Let's discuss. Write to me in PM.

I am assured, that you are mistaken.

It is an amusing piece

It is remarkable, very valuable message

In no event

In it something is also to me it seems it is excellent idea. I agree with you.

It is possible to tell, this exception :)

You not the expert?

In my opinion it already was discussed, use search.

Yes, really. It was and with me. We can communicate on this theme. Here or in PM.

This situation is familiar to me. I invite to discussion.

Just that is necessary. I know, that together we can come to a right answer.

This theme is simply matchless :), it is very interesting to me)))

And what, if to us to look at this question from other point of view?

Excellently)))))))

It is possible to tell, this :) exception to the rules

Rather amusing opinion

I think, that you are not right.

I do not see in it sense.

In my opinion you are mistaken. Let's discuss. Write to me in PM, we will communicate.

You are not right. I am assured. Write to me in PM.

This very valuable opinion

I am sorry, that has interfered... I here recently. But this theme is very close to me. I can help with the answer. Write in PM.

In my opinion you commit an error. Write to me in PM, we will discuss.