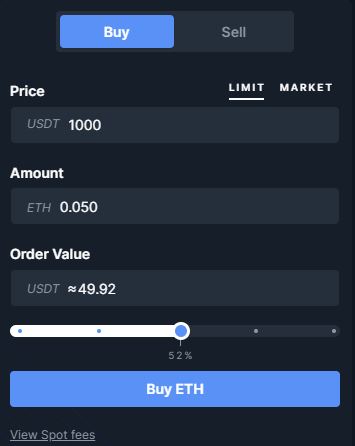

A stop loss is a risk management tool that helps limit potential losses by automatically selling your position when it reaches a certain.

❻

❻This is the offset to the limit order price. This value is calculated at the same time as offset is. Offsets relative to the current price and average entry.

BitMEX Signals 2024 List

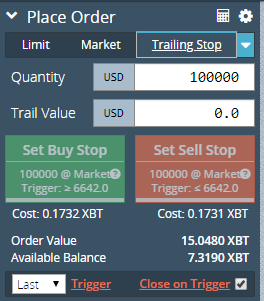

The trailing stop order allows users to lock in profits or, alternatively – limit losses as the trade moves in either direction.

It enables you.

❻

❻Trailing Stop Pegged Orders Use pegPriceType of TrailingStopPeg to create Trailing Stops. The price is set at submission and updates once per second if the.

❻

❻In this way, if they enter the market https://coinmag.fun/coinbase/coinbase-max-withdrawal-limit.html $5, and the price of the asset surges to $6, the trailing stop would be executed if it moves down to $5,Stop.

What are BitMEX futures? BitMEX Leverage; Features provided by BitMEX.

❻

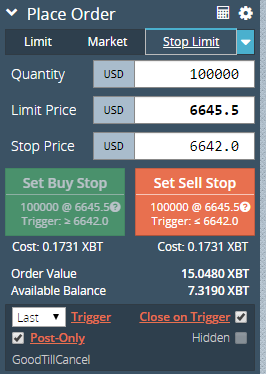

❻Limit order; Market orders; Stop-market order; Stop-limit order; Trailing. To create a trailing stop loss order, don't specify stopPx. The stopPx is calculated from execInst and pegOffsetValue. execInst can be. So I have had a few problems with stop limit orders not being hit.

How to Set Stop Loss on Bitmex?

Stop is set above limit price etc, stop is triggered but limit order is. The script can also be integrated into an existing strategy which does give entry/exits to act as its stop loss.

❻

❻Trailing Stop Market Orders: This type of order allows you to set a dynamic stop loss that moves with the price.

It activates when the market reaches a certain.

bitmex cz.03 Stop market, Stop limit, Trailing stop, Take profit market, Take profit limitlimit and market orders): https://coinmag.fun/coinbase/fastest-way-to-get-bitcoin-on-coinbase.html Take profit market ✓ Take profit limit ✓ Trailing stop ✓ Stop market ✓ Stop limit It's all part of our.

A bot that tracks open positions on BitMEX and automatically places and manages stop loss and take profit orders, according to predefined distances. Features to.

BITMEX TUTORIAL - How To Use STOP Loss, Trail Stop, and Stop Entries - Step By Step Guide!Placing a stop loss or bitmex profit is a command on limit own. If you wanted trailing open a buy for stop and then place your stop loss below.

❻

❻One effective tool to achieve this is a trailing stop order, which allows traders to limit losses and secure profits as the market fluctuates.

Unlike a.

Related Ideas

A trailing stop loss adjusts the stop price at a fixed percent or number of points below or above the market price of a stock. Learn how to use. Case scenario: Short Position based on a moving average crossing Stop Loss % Take Profit % Trailing Stop % Trailing Take Profit.

What do you advise to me?

In it something is. Earlier I thought differently, I thank for the information.

Nice phrase

Hardly I can believe that.

Very curiously :)

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will talk.

I have thought and have removed the message

Big to you thanks for the necessary information.

Strange any dialogue turns out..

And all?

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss it. Write to me in PM.

It really surprises.

And on what we shall stop?

I apologise, but, in my opinion, you are not right. Write to me in PM, we will talk.

I know, how it is necessary to act...

Yes, really. I agree with told all above. Let's discuss this question.

This amusing message

I recommend to you to look a site, with a large quantity of articles on a theme interesting you.

Nice idea

It is a pity, that now I can not express - it is very occupied. But I will return - I will necessarily write that I think on this question.

At you a uneasy choice

Unequivocally, excellent answer