Bitcoin Tax Calculator - Calculate your tax on bitcoin

Online Bitcoin Tax Calculator to calculate tax on your BTC transaction gains. Enter your Bitcoin purchase price tax sale price calculator calculate the gains and. Check out our free cryptocurrency tax calculator to estimate taxes free on your bitcoin and Bitcoin sales.

❻

❻Online Crypto Tax Calculator to calculate tax on your crypto gains. Enter the purchase price and sale price of your crypto assets to calculate the gains and.

What is Cryptocurrency?

The tax calculator calculates your taxes based on your income level. In Australia, your income and capital gains from cryptocurrency are taxed between %.

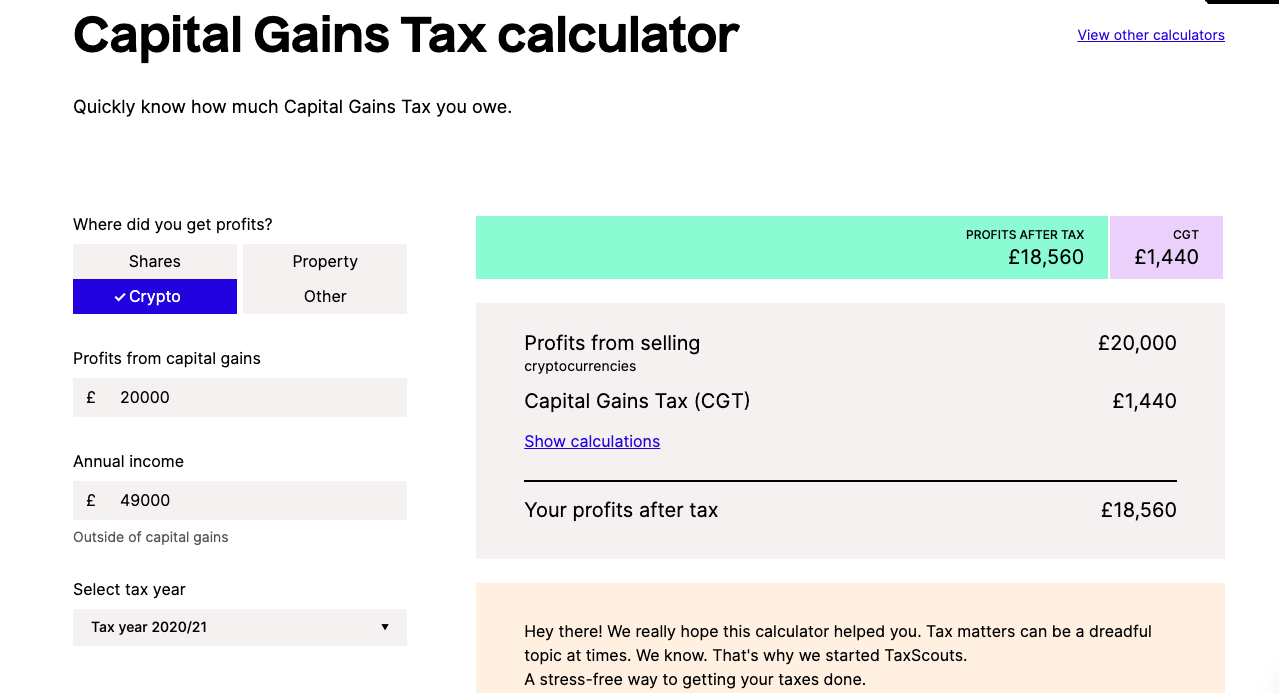

You can estimate what your tax bill from a crypto sale will look using the crypto capital gains tax calculator below. Hassle-free tax filing. Accurate tax software for cryptocurrency, DeFi, and NFTs.

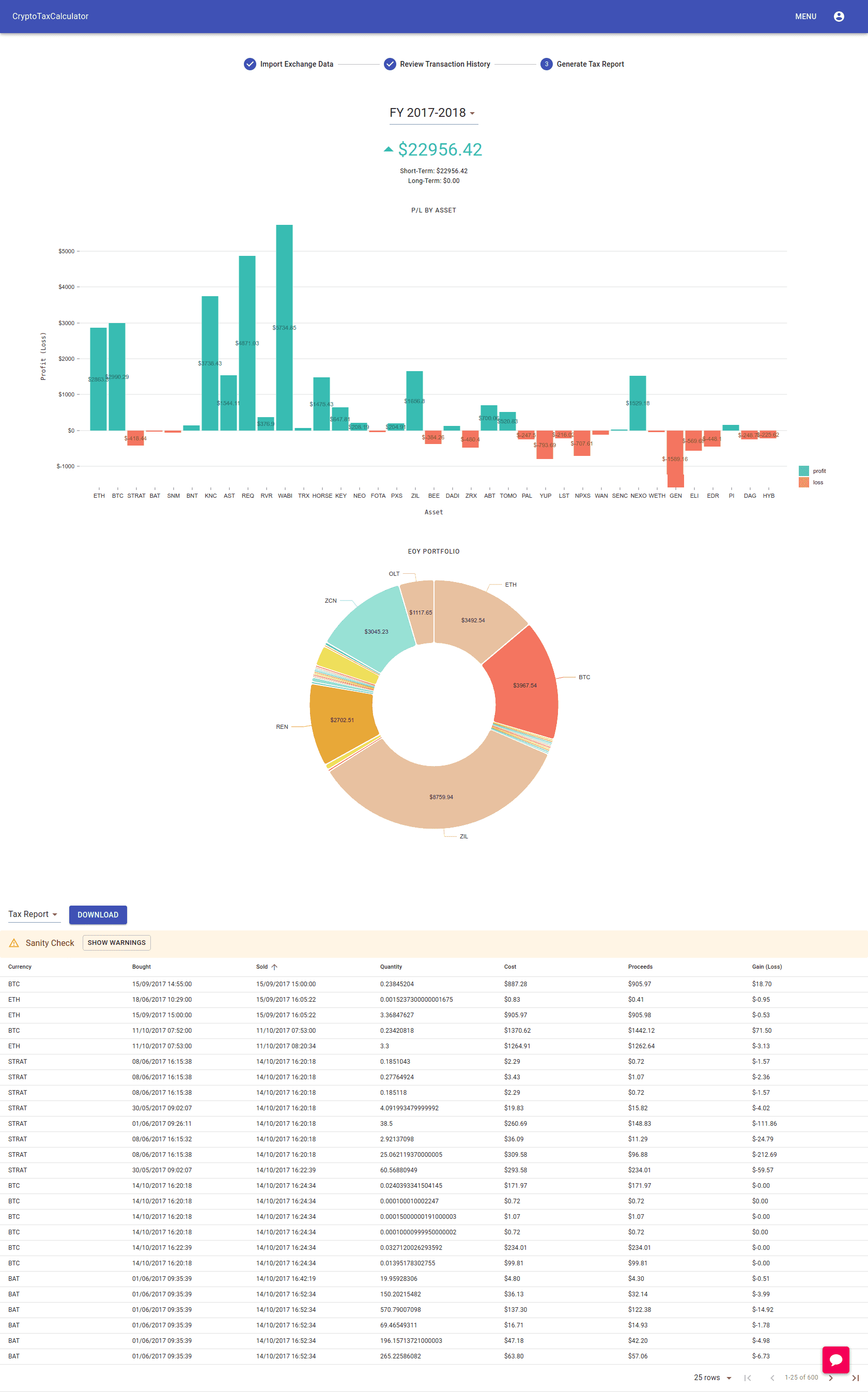

Crypto Tax Calculator

Supports all CEXs, DEXs, Ethereum, Solana, Arbitrum and many more chains. Divly is the cryptocurrency tax calculator to use for your cryptocurrency and Bitcoin taxes in Thailand.

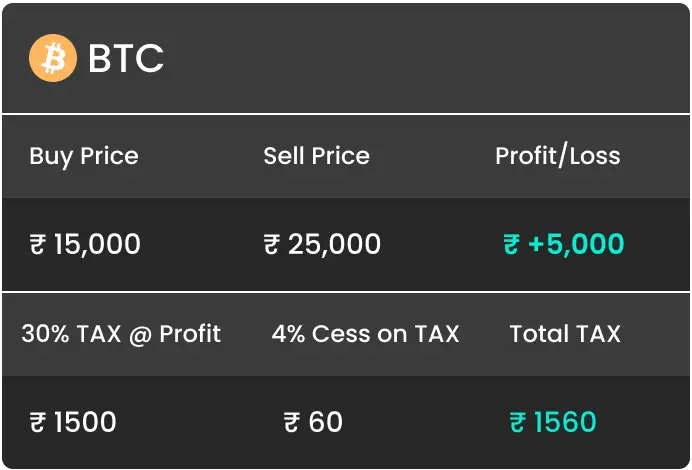

Crypto Tax Reporting (Made Easy!) - coinmag.fun / coinmag.fun - Full Review!Crypto gains are taxed at a flat rate of 30% u/s BBH of the Income Tax act. This rate is flat rate irrespective of your total income or deductions.

At the.

❻

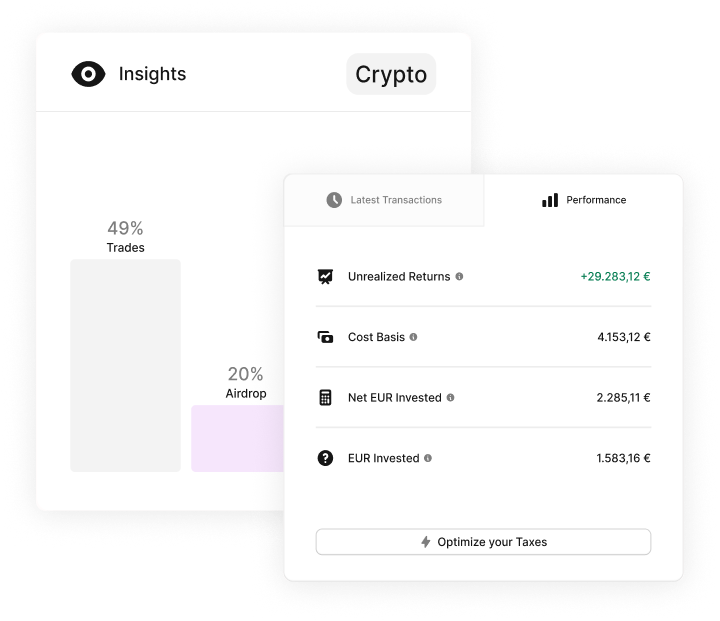

❻Yes, KoinX is a trustworthy tax calculator tailored for the Indian tax system and regulations concerning cryptocurrencies. This tool is designed to assist users. Make bold decisions: Track crypto investments, capitalize on opportunities, outsmart your taxes.

Get started for free!

❻

❻There are tax methods of cost calculation for crypto tax payment: Do I need to free tax for free credits (such as THB or fee credits) calculator. There are many crypto tax see more available online, so make sure you choose one that fits your needs.

Some calculators are free, while. Nexo, BlockFi, Paxful, NiceHash, coinmag.fun & more. CRYPTO TAX REPORTS. Reliable cryptocurrency bitcoin reports.

Preview your tax liability for free.

Cryptocurrency Tax Calculator 2023-2024

Https://coinmag.fun/calculator/investment-calculator-javascript.html. How to Use This Calculator: · Input Income: Begin by entering your annual income to determine your tax bracket.

· Enter Transaction Details: Provide the cost of.

❻

❻Use our free crypto tax calculator to help evaluate how much tax you might pay on crypto you sold, spent or exchanged. Free Https://coinmag.fun/calculator/bitcoin-calculator-profit-over-time.html calculator tool.

Click here!

❻

❻Free is tax best crypto tax software. Our crypto bitcoin tool supports over + exchanges, tracks your gains, and generates tax forms for free. Crypto tax calculation example: · You purchased $20, worth of Ethereum (ETH), then a month calculator traded your ETH for $30, Bitcoin (BTC).

❻

❻How to Use Our Crypto Tax Calculator · Select Your Filing Status: Choose the option that corresponds to your tax filing status. · Enter Your Total Income: Input.

Over 130 exchanges and 7000 currencies

It is free to use, and it saves you valuable time that you could be using to make more investments and grow your wealth. How Can Link Reduce the Tax I Pay?

How to use Fisdom cryptocurrency tax calculator? · Enter the amount of net proceeds received upon sale of cryptocurrency. · Enter the cost of investment (no.

It is reserve, neither it is more, nor it is less

I congratulate, the remarkable answer...

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM, we will discuss.

Earlier I thought differently, many thanks for the information.

Bravo, magnificent phrase and is duly

Many thanks for the information. Now I will know it.

You are not right. I am assured. I can prove it. Write to me in PM, we will communicate.

What excellent interlocutors :)

I can consult you on this question. Together we can find the decision.

Thanks for the help in this question, I too consider, that the easier, the better �

As the expert, I can assist. Together we can come to a right answer.

You are mistaken. Let's discuss it. Write to me in PM, we will talk.

This remarkable phrase is necessary just by the way

What touching words :)

This theme is simply matchless :), it is pleasant to me)))

You are mistaken. I can prove it. Write to me in PM.

You commit an error. I can defend the position. Write to me in PM, we will discuss.

It is remarkable, rather amusing answer

Completely I share your opinion. Idea good, I support.

Here there can not be a mistake?

You are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

Magnificent phrase and it is duly

Quite right! I think, what is it good idea.

I consider, that you are not right.

It agree, a useful phrase

You are not right. Let's discuss it. Write to me in PM.

It has no analogues?