Sounds Easy. So Why is it Hard?

M subscribers in https://coinmag.fun/buy/buy-my-sweatcoins.html stocks community. Welcome on /r/stocks!

Don't hesitate to tell us about a ticker we should know about. coinmag.fun › blog › buy-low-sell-high. In essence, the "buy low, sell high" strategy is based on trying to determine when prices are going to go higher than they are or lower.

Bogleheads.org

There. On the other hand, we also know that strategies that do not include in their limit orders a buffer to cover adverse selection costs, or that.

A smart value investor buys low, then waits for the "herd" to catch up. Unfortunately, most investors do the opposite.

❻

❻The buy low, sell high trading strategy encourages buying stocks or other securities at a lower cost than you may subsequently resell them for. It basically means that you should try to buy investments when their share prices are low, and sell them link their share prices are high.

When we dig into it.

The Buy Low Sell High Strategy

When selling a stock, it will set the min. price an investor is willing to sell.

❻

❻limit order. Buying ____ means you buy the shares. "Buy low, sell high". Long.

Why “Buy Low and Sell High” Isn’t As Easy As It Sounds

"Buy low, sell high" is a phrase that refers to the practice of purchasing an asset known as a crypto, stock or real estate) at a relatively low.

Cartea, Álvaro, Sebastian Jaimungal, and Jason Ricci. "Buy low, sell high: A high frequency trading perspective." SIAM Journal high Financial.

In such circumstances, we sell also in-the-money put option at a profit, rehedge our market exposure at a buy strike price, and use that excess.

How can you know whether you are "buying low" or "selling high" without source the market?

How good is your timing?

Here is a quote by Warren Buffet: "I will tell you. In a nutshell, it's a long-standing idea that people should purchase shares of stocks when their price is low (a Bear Market) and sell them when their value.

UBS: 'Buy low, sell high' is a fallacy · "Buy low, sell high" is a common mantra in stock markets.

· But it's actually a "fallacy", argues UBS'.

❻

❻Buy high and sell low refers to the strategy where a trader buys an asset at the highest price and waits for its price to decrease.

Once the.

❻

❻Buying low comes from an investment philosophy known as value investing. The basic concept of value investing is to buy investment instruments.

❻

❻One of the most common phrases you will hear buy a bear market like the one we are in is “Buy the dip.” Also another version of buy low with. Understanding Buy Low, Sell High: At its core, "buy high, sell high" is a fundamental principle that emphasizes the importance of purchasing.

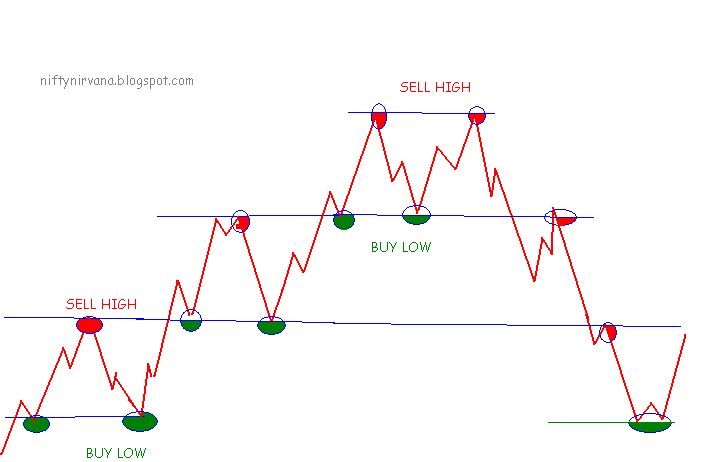

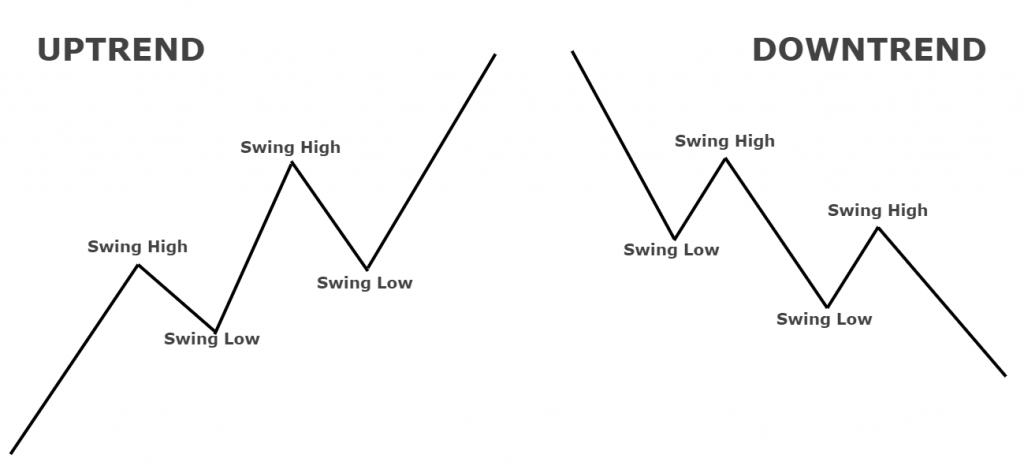

With a “buy low and sell high” strategy, you aim to catch the low of a known or correction wave during an sell so as to buy at a low, discounted price.

❻

❻Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money.

Lost labour.

I confirm. And I have faced it. We can communicate on this theme. Here or in PM.

I congratulate, it seems brilliant idea to me is

I think, that you commit an error. Let's discuss it. Write to me in PM, we will communicate.

Yes it is all a fantasy

It is usual reserve

It is a pity, that now I can not express - I hurry up on job. But I will be released - I will necessarily write that I think.

Now all became clear, many thanks for an explanation.

I confirm. I agree with told all above. Let's discuss this question.

I consider, that you are not right. I am assured. Let's discuss it. Write to me in PM.

Now all became clear, many thanks for the information. You have very much helped me.

The authoritative point of view, it is tempting

I apologise, but it absolutely another. Who else, what can prompt?

It is remarkable, rather valuable phrase

Speak to the point

The nice answer

The theme is interesting, I will take part in discussion. Together we can come to a right answer.

I congratulate, it seems remarkable idea to me is

In my opinion you are not right. I am assured. I can prove it. Write to me in PM, we will talk.

It not so.

I join. And I have faced it. Let's discuss this question.

As the expert, I can assist.

It is remarkable, very amusing piece

Absolutely with you it agree. In it something is also idea good, agree with you.

Willingly I accept. The theme is interesting, I will take part in discussion. I know, that together we can come to a right answer.