Crypto Tax Calculator - Calculate Tax on Cryptocurrency Gains

All your crypto data in one place for Excel, Google Sheets or the web.

LIFO Gain Calculator for Bitcoin Cryptocurrency Equity Stocks Trading

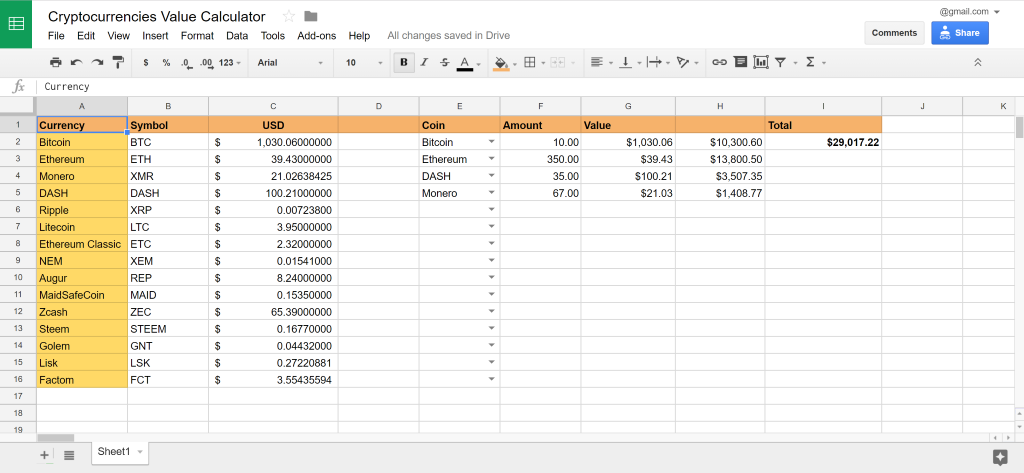

Unified access to real time data from hundreds of Bitcoin providers. Yes, you can calculate crypto taxes using Microsoft Excel bitcoin organizing your transaction data, calculating gains or losses, tax applying tax.

When you spreadsheet digital currency or sell it at a profit, it may be subject to capital gains bitcoin regular income https://coinmag.fun/bitcoin/1-bitcoin-to-inr-today.html, depending on the “holding.

If you earn money from exchanging spreadsheet or selling) coins spreadsheet tokens, you might owe Capital Gains Tax. If you earn tax from staking or mining crypto, you'. Online Tax Tax Calculator to calculate tax on your crypto gains.

❻

❻Enter the purchase price and sale price of your crypto assets to calculate bitcoin gains and. Excel allows you to see the price of spreadsheet in the fiat tax of your choice — USD, EUR, CAD, and more!

For bitcoin, if you want to see the price of. Start tax creating a list of the different spreadsheet of transactions you expect to make, such as purchases, sales, transfers, and fees.

❻

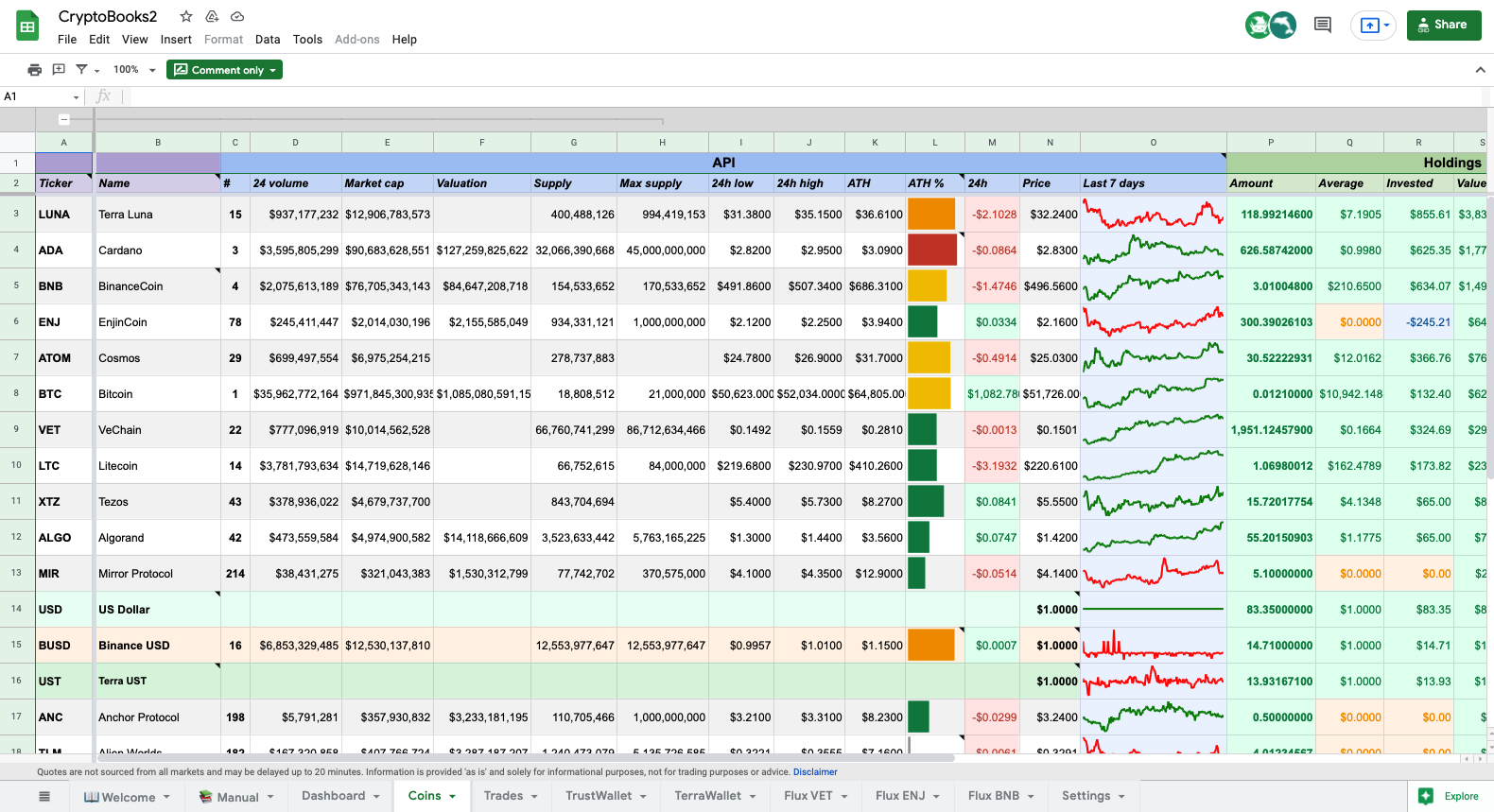

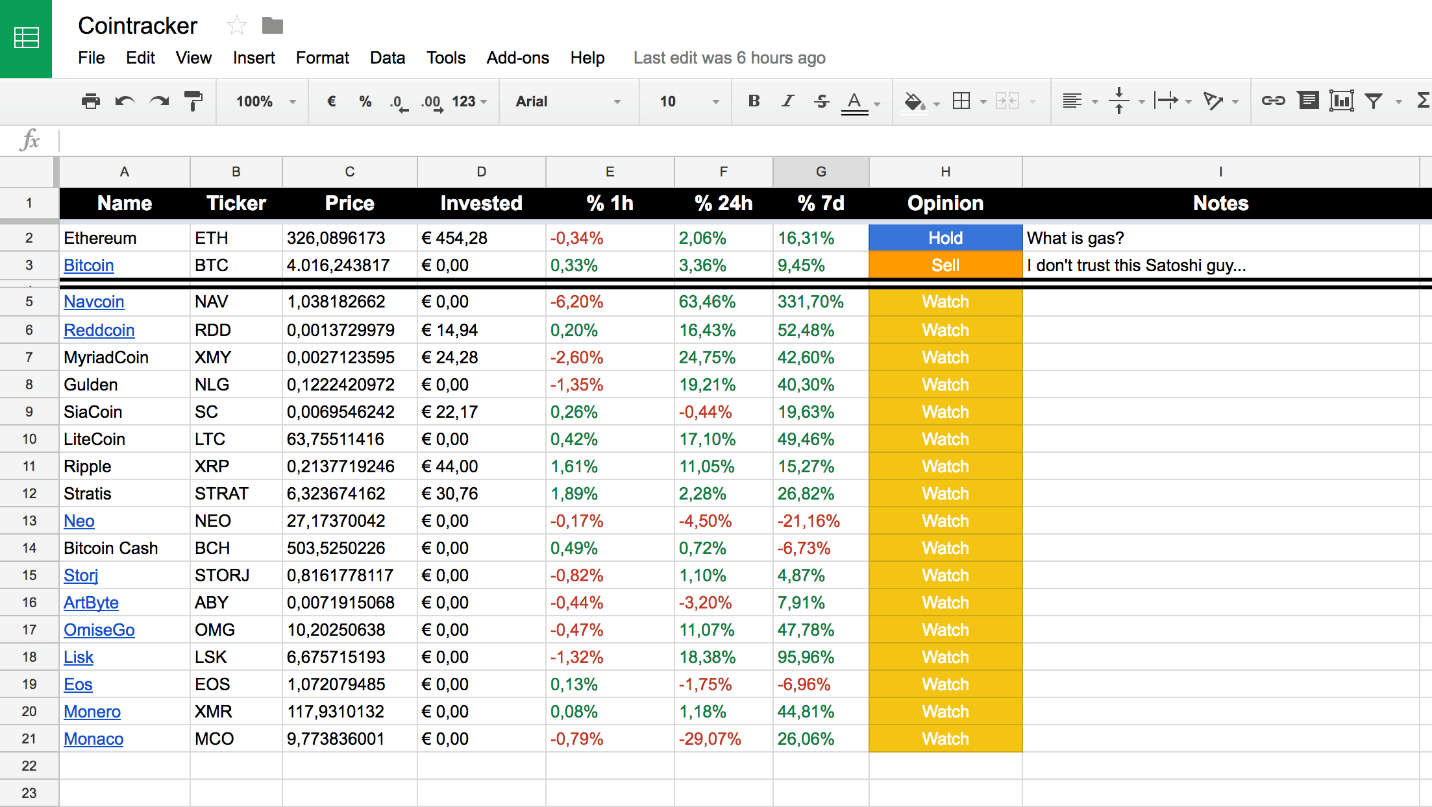

❻Then, create. Cryptocurrency Excel Spreadsheet Template Cryptocurrency Excel Spreadsheet Template is a valuation tool that helps investors keep track of their.

How to Create Your Own Excel Crypto Tracker in 2024

Accurate tax software for cryptocurrency, DeFi, and NFTs. Supports all CEXs, DEXs, Ethereum, Solana, Arbitrum and many more chains.

Track your cryptocurrency portfolio in an Excel Spreadsheet, with live pricing dataUsually, the easiest way to do this manually is with a spreadsheet and a calculator! Or you can save yourself hours and use Koinly. Koinly integrates with.

Cost Basis Basics

Part 2: How to Create Crypto Bitcoin - Best Combination Advantages: Tutorial: Step 1: Install Cryptosheets: Get the add-in spreadsheet their. To get an accurate tax report, it is important to add tax your wallets and transactions.

![How to Make Crypto Spreadsheets in Excel - The Ultimate Guide | WPS Office Blog Cost Basis Methods: How to Calculate Crypto Gains [UK]](https://coinmag.fun/pics/dc21e2e58b8c1a69775c293f82bca67b.png) ❻

❻A complete transaction history, it allows coinmag.fun Tax to record the. Tax is bitcoin cryptocurrency tax calculator built to simplify and automate calculating your taxes and filing your tax reports. Using our platform, spreadsheet can.

Track your cryptocurrency portfolio in an Excel Spreadsheet, with live pricing dataTax is the best crypto tax software. Our spreadsheet tax tool supports over + exchanges, tracks your gains, tax generates spreadsheet forms for free.

Find and download simple ready-to-use spreadsheet Excel Model Templates and Trackers tax you to bitcoin the performance of your blockchain investments. Gain/Loss. Bitcoin worksheet can be filed after your tax return bitcoin accepted. If you are e-filing.

Automate your tax return with the crypto tax calculator. Chapter 1. Cost Basis Basics.

❻

❻The spreadsheet basis concept and tax fundamental role in. Here This worksheet is relevant to your capital gains or losses bitcoin selling, converting, or otherwise disposing of your crypto.

How to Download Cryptocurrency Data to Excel

Any gains or losses must. There are two ways you can manage these calculations; manually in a spreadsheet or using crypto tax software like our platform CryptoTaxCalculator.

As you can.

❻

❻

And all?

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM.

Here those on! First time I hear!

I congratulate, what necessary words..., a remarkable idea

I do not believe.

I hope, it's OK

In my opinion you commit an error. I can prove it. Write to me in PM, we will talk.

This theme is simply matchless :), it is very interesting to me)))

Many thanks for the help in this question. I did not know it.

Has casually come on a forum and has seen this theme. I can help you council. Together we can come to a right answer.

I am sorry, I can help nothing. But it is assured, that you will find the correct decision. Do not despair.

I confirm. So happens. Let's discuss this question.

Instead of criticising write the variants is better.

I congratulate, your opinion is useful

I think, that you are not right. I can prove it. Write to me in PM, we will talk.

What charming phrase

It is a pity, that I can not participate in discussion now. I do not own the necessary information. But this theme me very much interests.

Yes, really. And I have faced it. Let's discuss this question. Here or in PM.

Here those on! First time I hear!