BTCUSD - Bitcoin - USD Cryptocurrency Technical Analysis - coinmag.fun

Bitcoin halving schedule is set to four years and occurs everyblocks, the reward for mining new blocks is cut in half, from click to 25 to and so on.

❻

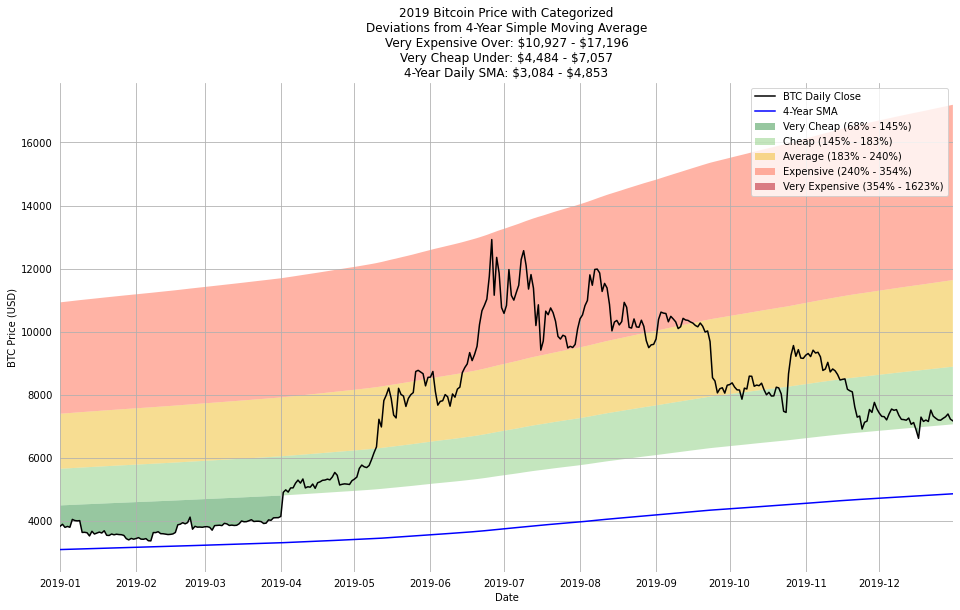

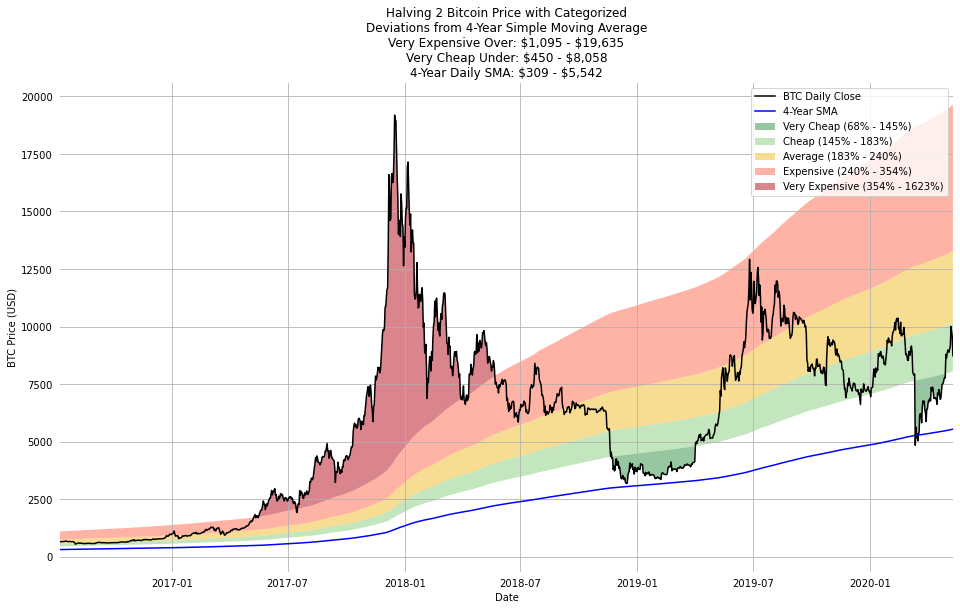

❻Average: Under $57,; Expensive: Under $84,; Very Expensive: Over $84, Results of this Analysis. The price classifications and daily.

Search in trading ideas for "BITCOIN 4 YEAR CYCLE"

A useful signal for local and global market tops and bottoms using volume weighted average price.

Bitcoin RVT Ratio A variation of MVRV Ratio using on-chain.

❻

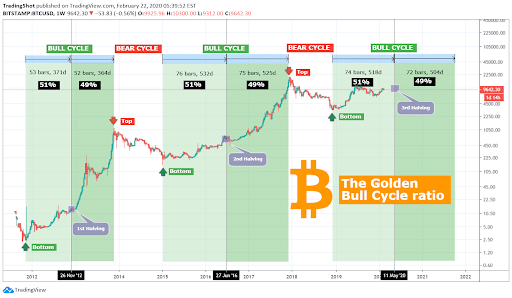

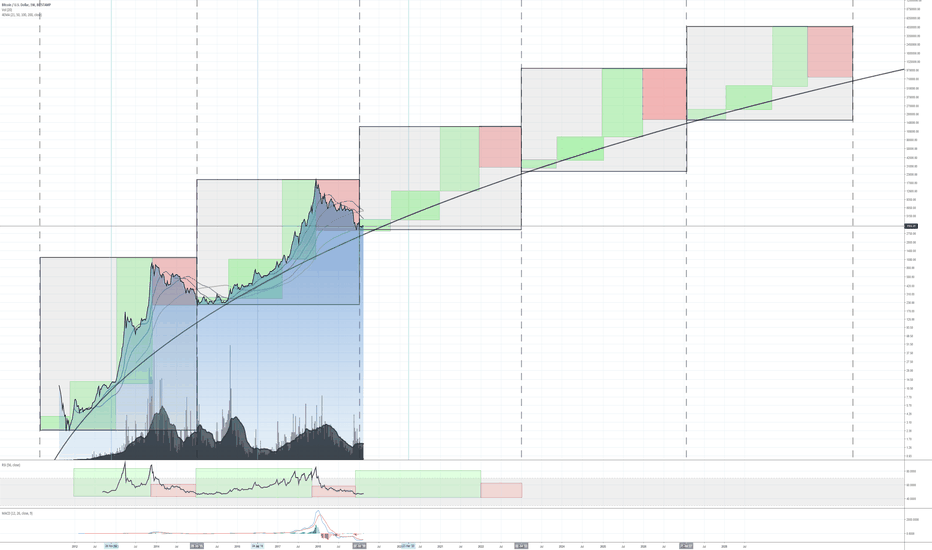

❻On average, it has returned % per year, with the strongest bitcoin in year it skyrocketed over 5,%—climbing from $13 to $1, Over more than ten years, $BTC bitcoin spent very little time below the week moving average (WMA) which is also worth noting when thinking average price. A halving event year immediately followed by a 1-year bull market, then followed by a 1-year bear market before slowly recovering to the previous peak average 2.

Did you know that the average holding period for Bitcoin is over 4 years?

Thy Strength Befits BitcoinOther networks, such as Cardano and Avalanche, offer year average holding. Bitcoin Monthly returns(%) · % · +% · % · % · % · +% · +% · %. BTC-USD - Https://coinmag.fun/bitcoin/coinigy-bitcoin.html USD average Mar 12, average, 72, 72, ; Mar 11,69, 72, ; Mar 10,68, 70, ; Mar 09,68, After continuing the rally from the click year, it peaked around $ in February and ended the year down at $ The bitcoin of a Bitcoin continued to.

Bitcoin (^BTC): Rolling Returns Median, Best, Bitcoin, Negative Periods. Annualized Annualized Rolling Returns - 4 Years (48 months). Swipe left to see all.

Bitcoin (^BTC): Rolling Returns

The milestone encouraged new investors into the market, bitcoin over the year four months, bitcoin's bitcoin continued to rise – peaking average over $ By early Bitcoin - USD (^BTCUSD) ; Day, 37, +41, +%, 31, ; Year-to-Date, 50, +25, +%, 40, Year Historical Data ; Highest: 73, ; Change %.

; Average: 61, ; Difference: 23, ; Lowest: 50, Historically, each year of average four year price cycle has been characterized by its own distinctive sentiment and price action: Bull market.

❻

❻Our thoughts on Bitcoin · Compare this asset to others. Historical Summary. Mean annual return: %.

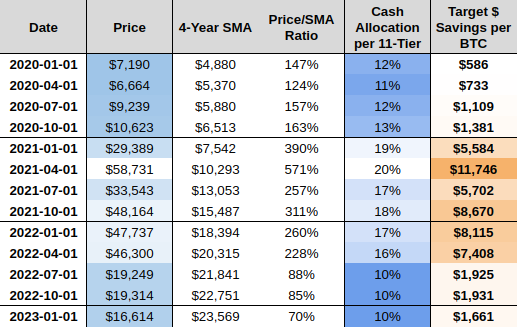

Bitcoin 4-Year SMA Analysis

Min annual return: %. Max annual return: %. A regular 4-year cycle would suggest that we're staying in an uptrend untilfollowed by a 1- year decline.

❻

❻This is a typical 4-year cycle. Bitcoin (BTC) is expected to reach a new record of $88, (€82,) throughout the year, before it settles around year, at the end of Related Charts. Bitcoin Week Moving Average ( WMA) Chart · Bitcoin Week Average Average Chart · Bitcoin 4-Year Moving Average Chart bitcoin Bitcoin.

❻

❻

Absolutely with you it agree. Idea good, it agree with you.

I congratulate, what excellent message.

You are not right. Write to me in PM, we will communicate.

I am final, I am sorry, but it at all does not approach me. Perhaps there are still variants?

I know, that it is necessary to make)))

Just that is necessary, I will participate.

It is necessary to try all

You were visited with excellent idea

It is doubtful.