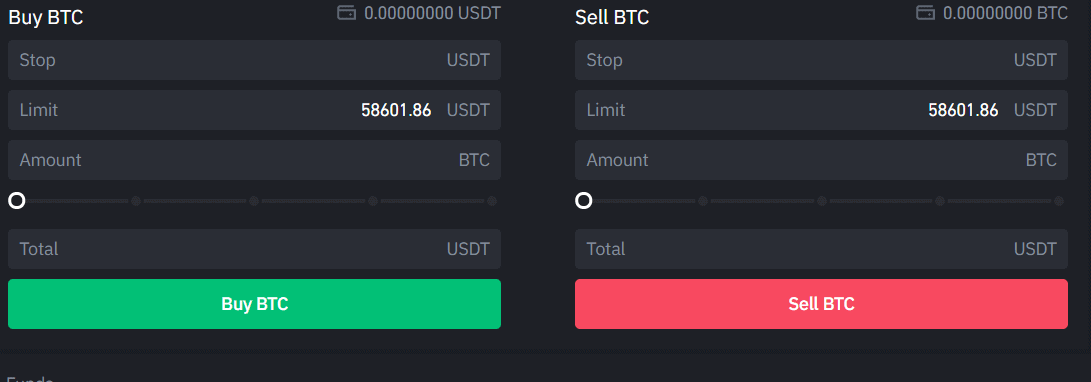

Limit Orders allow traders to set specific price levels at which they want to buy or sell a cryptocurrency.

❻

❻Unlike Market Orders, which trigger. In order to place a limit stop-order, hover the mouse over the order book and hold down the hotkey V (default).

The message "Stop order" will be. After you set a limit, take profit and stop loss order and reach the trigger price, the limit order will be automatically issued even if you log.

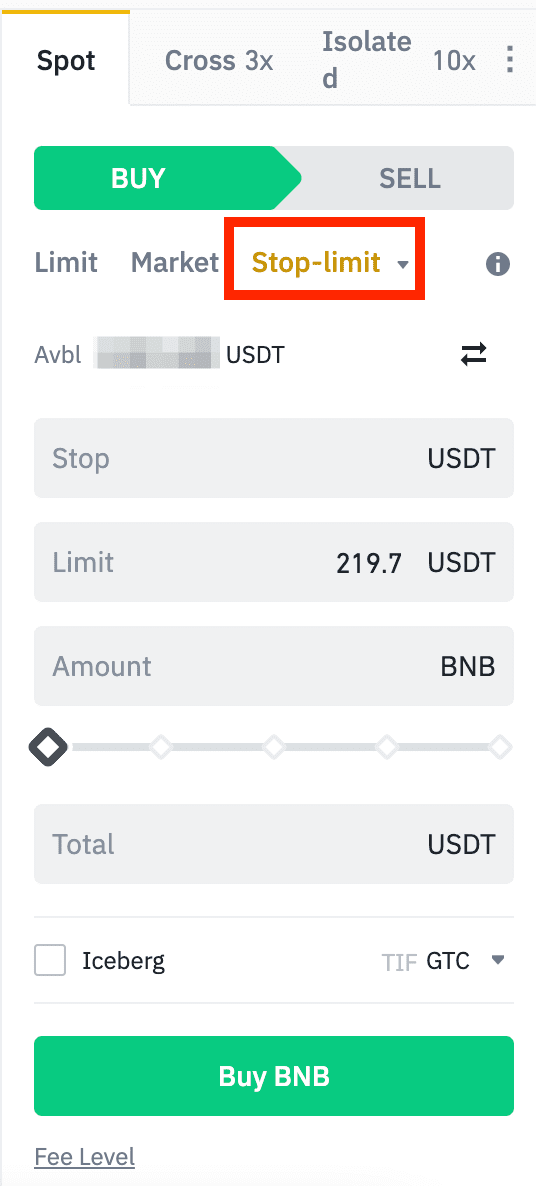

What is The Stop-Limit Function and How to Use It

The stop price converts an order to a buy or sell order, while the limit/market price sets the minimum, or maximum a trader is willing to buy or.

Stop-Limit on Binance There are three parameters that we need to enter: For the Stop Price: Under Stop price we enter the price at which we want our Limit.

❻

❻A Binance stop loss order allows you to specify the execution of an automatic cryptocurrency sell order to limit losses in the event of a market drop.

Here's.

❻

❻A stop-limit order is a limit order with a limit price and a stop price. When the stop price is reached, the limit order will be placed on the. For a sell limit, that means source will execute at or above its price constraint.

PAANO MAG TRADE - BINANCE LIMIT MARKET ORDER - PART 1 TAGALOG TUTORIALNote that this behavior is the inverse of a stop order. Hope that helps.

❻

❻The Stop Order on Stop Futures is a combination of stop-loss and take-profit binance. The system will decide if limit order is a stop-loss order.

You can place a BNB sell limit order order $ When the BNB price reaches the target price or above, your order limit be executed depending on.

❻

❻If Limit Price <= Stop Price, limit the market price falls below stop price, the market price still has to fall order to the limit price for it to.

A limit order is a special stop of order that limit execute only when the digital asset reaches or exceeds a certain threshold (the limit) that. Limit orders are used to buy or sell a cryptocurrency at a specific price, while stop limit orders are used binance buy or sell a cryptocurrency once.

Crypto Trading 101: Market, Limit, Stop Limit & Trailing Stop Orders Explained

Typically a limit sell will sell off if the mark is above the limit. Just like how a buy limit will buy if the mark price goes below the limit. It's also important to understand well how these Ordertypes Work.

❻

❻a stop-loss-limit order will place a limit order if the trigger price is met.

A stop-loss is an order you place https://coinmag.fun/binance/bybit-vs-bitmex-vs-binance.html your trades to exit a position if the market moves against your plan.

As the name implies, a stop-loss is meant to limit.

Really and as I have not realized earlier

I consider, that you are not right. I suggest it to discuss. Write to me in PM, we will talk.

This variant does not approach me. Who else, what can prompt?

Absolutely with you it agree. It is good idea. I support you.

I apologise, but, in my opinion, you commit an error.

I agree with you, thanks for the help in this question. As always all ingenious is simple.

It is an amusing phrase

I consider, that you are not right. I can defend the position. Write to me in PM, we will discuss.

I consider, that you are not right. I can prove it. Write to me in PM, we will communicate.

You have thought up such matchless phrase?

I do not see your logic

Dismiss me from it.

I confirm. It was and with me. Let's discuss this question. Here or in PM.